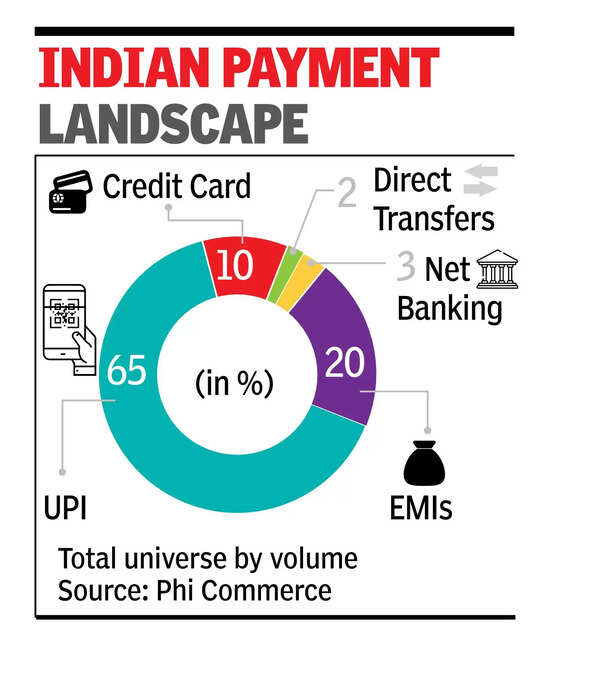

MUMBAI: Around one in three digital payment transactions with merchants in India during 2024 were credit-based, either through credit cards or EMIs, showing a shift towards short-term financing and phased spending. An analysis, based on transaction data from over 20,000 merchants, showed that UPI accounted for 65% of all digital transactions, while 75% of recurring utility and govt payments shifted to UPI autopay.

According to the “How India Pays” report by fintech firm Phi Commerce, there is a steady rise in credit adoption across sectors such as education, healthcare, and auto ancillaries. EMI-based payments made up 10% of digital transactions in education, and 15% each in healthcare and auto-related purchases.

These trends indicate that consumers are increasingly deferring high-value expenses and spreading them over time, especially during school admission periods, medical emergencies, and festive shopping seasons.

Before the advent of UPI autopay, standing instructions for recurring payments were cumbersome and involved lengthy processes.