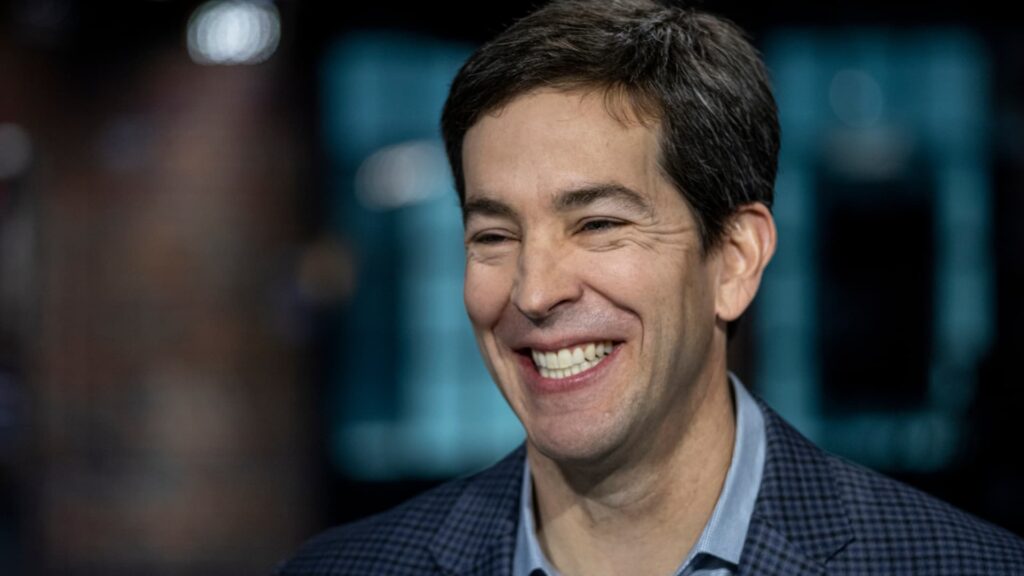

Todd McKinnon, chief executive officer of Okta Inc., smiles during a Bloomberg Technology television interview in San Francisco, California, U.S., on Monday, April 4, 2022.

David Paul Morris | Bloomberg | Getty Images

Okta shares soared 22% on Tuesday after the cloud-based identity management company delivered strong fourth-quarter earnings and beat estimates on guidance.

The move put the stock on pace for its best day in more than a year.

Okta posted adjusted earnings late Monday of 78 cents per share, while revenue increased 13% from a year earlier to $682 million. That beat the average analyst estimates of 73 cents per share of earnings and $669.6 million in revenue, according to LSEG.

First-quarter revenue should come in between $678 million and $680 million, which also topped estimates.

On the company’s earnings call, CEO Todd McKinnon called it a “blowout quarter” as bookings topped $1 billion in a single period for the first time.

“We’re excited about the momentum we’ve built going into FY 2026 and are taking the right steps to advance our position as the leader in the identity market,” McKinnon said. “More and more customers are looking to consolidate their disparate and ineffective identity systems, and Okta is there to meet them with the most comprehensive identity security platform in the market today.”

Okta allows companies to manage employee access or devices by providing tools such as single sign-on and multifactor authentication. Shares have rallied about 35% this year, including Tuesday’s pop, after slumping 13% in 2024. In late 2023, Okta suffered a high-profile data breach that gave access to client files through a support system.

Some Wall Street firms turned more positive on the stock after the latest results, with both D.A. Davidson and Mizuho upgrading their ratings. D.A. Davidson called the likelihood of double-digit growth “durable” as the company shows signs of stabilization.

Mizuho’s Gregg Moskowitz said the firm “underestimated” the upside to committed remaining performance obligations, or subscription backlog that the company expects to recognize as revenue over the next year.

“More broadly, OKTA continues to be a clear leader in the critically important identity management market,” Moskowitz wrote. “And we now have a higher confidence level that OKTA will increasingly benefit from its group of newer products that have already begun to drive a meaningful contribution.”

WATCH: Okta CEO Todd McKinnon talks to Cramer