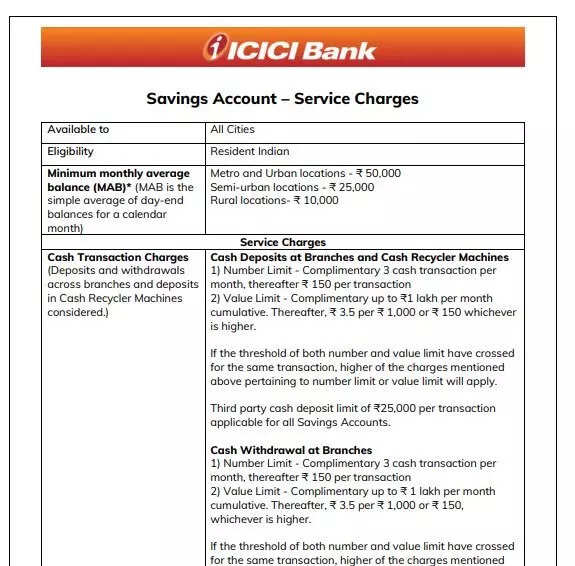

ICICI Bank, India’s second-largest lender, has increased the monthly minimum average balance requirement for new savings account holders, effective August 1.For accounts opened after this date, customers in metro and urban branches will need to maintain a monthly average balance of Rs 50,000, up from the earlier Rs 10,000. In semi-urban branches, the requirement has risen to Rs 25,000 (earlier Rs 5,000), while rural branches will now require Rs 10,000 (earlier Rs 2,500). The MAB is calculated as the average of day-end balances in a calendar month.This change affects only new accounts opened on or after August 1, existing customers continue with the earlier limits of Rs 10,000 in metros/urban areas and Rs 5,000 in semi-urban/rural branches.

The latest rule changes could influence customers to rethink their banking preferences, possibly shifting to banks with lower minimum balance requirements or opting for basic savings accounts without such thresholds. As per the new policy, customers who fail to maintain the required monthly average balance (MAB) will face a penalty of 6% of the shortfall or Rs 500, whichever is lower. These charges, however, will be waived if the customer qualifies under the bank’s enrolled program criteria.The bank has also revised its cash transaction policy for deposits and withdrawals across branches and through Cash Recycler Machines.Customers will now get three free cash transactions per month across branches and Cash Recycler Machines; beyond that, a fee of Rs 150 per transaction will apply.For ECS/NACH debit returns due to insufficient funds, the bank will levy Rs 500 per instance, capped at three charges per month for the same mandate, ANI reported.Outward cheque returns (cheques deposited by the customer) will attract a Rs 200 fee per instance for financial reasons. Inward cheque returns (cheques issued by the customer) will be charged at Rs 500 for financial reasons and Rs 50 for non-financial reasons, excluding signature verification.Additionally, declined transactions at another bank’s ATM or at a point of sale (POS) terminal due to insufficient balance will incur a Rs 25 fee per instance.