MUMBAI: IndusInd Bank said valuation losses in its forex derivative contracts could impact the bank’s net worth by up to 2.4% or around Rs 1,530 crore. The announcement came hours after shares of the bank closed nearly 4% lower on Monday. The fall was triggered by RBI’s decision to approve only one-year extension for MD & CEO Sumant Kathpalia as against three years proposed by the board.

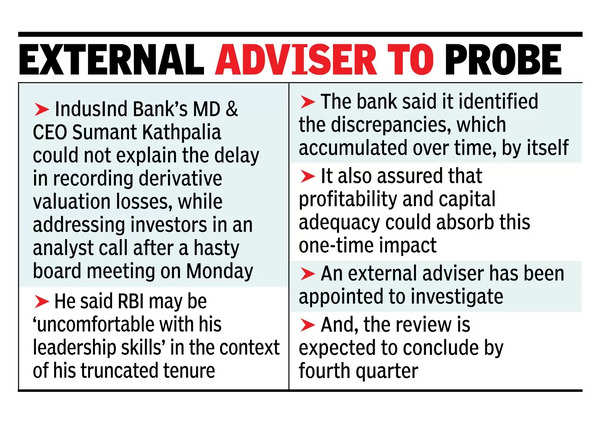

Following a hasty board meeting on Monday, Kathpalia addressed investors in an analyst call. He could not explain the delay in recording the derivative valuation losses but said RBI may be ‘uncomfortable with his leadership skills’ in the context of his truncated tenure.

The bank said it identified the discrepancies, which accumulated over time, by itself and assured that its profitability and capital adequacy could absorb the one-time impact. An external adviser has been appointed to investigate, with the review expected to conclude by fourth quarter.

External advisor to probe

“As part of circular which came in Dec 22/Sep 23, we started reviewing our derivative book as effective April 24, new guidelines for internal trades had to be discontinued. We started observing some discrepancies in our business, which were identified between Sept and Oct, and we hired an external agency to review our business,” said Kathpalia. He said that all the discrepancies pertained to FY24 and earlier.

RBI’s Dec 2022 circular restricted banks from allowing speculative or unregulated hedging for clients by ensuring that hedging is only permitted for actual or anticipated commodity price and freight risks. Banks also had to ensure that the hedge aligned with the entity’s exposure and was restricted to approved products, such as futures, swaps, and options.

Forex derivatives are contracts used to bet on currency value changes, without buying or selling the currency. While useful for businesses to hedge against currency fluctuations, they can hurt banks if used for speculation, especially during sudden change in currency value. The rupee, which was steady against dollar for several years, had depreciated sharply after the Russian invasion of Ukraine. Those who would have bet on rupee remaining strong would have faced losses.

IndusInd Bank said discrepancies stemmed from internal trades related to foreign currency positions, which were initially used to balance the bank’s foreign currency books. Had the losses been identified in time the bank would have taken a hit in its trading income and interest income. The issue, however, was only discovered in last few months, despite multiple audits over the years.