MUMBAI: Retail investors continued to invest through the mutual fund route in Feb despite a volatile market. However, they made some changes to their investment pattern, top MF executives and analysts said after industry body Amfi on Wednesday released the data for Feb.

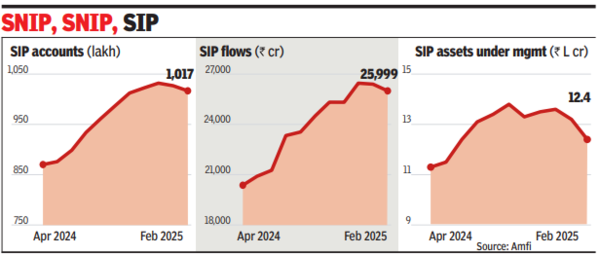

Monthly gross inflows through the SIP route, that over the last few years have emerged as the preferred mode of investing for retail investors, dipped to Rs 25,999 crore in Feb from Rs 26,400 crore in Jan.

Amfi chief Venkat Chalasani pointed out that Feb usually records a dip in gross SIP flows. On an annual basis, monthly SIP flows, however, showed a nearly 36% jump from Rs 19,187 crore in Feb 2024. The latest data also showed that equity inflows dipped 26% on the month, although it was the 48th consecutive month of net inflows.

Snip, Snip, Sip

Despite net positive flows through equity funds, thanks to the bad market conditions in Feb, fund industry’s total assets under management (AUM) fell 4% to about Rs 64.5 lakh crore from Rs 67.3 lakh crore in the previous month. “The decline in the overall AUM from Jan to Feb was primarily due to mark-to-market losses in equity funds,” Chalasani said.

Debt funds showed a net outflow of about Rs 6,500 crore that industry analysts said was mostly due to corporate activities, especially withdrawals by treasuries of large companies. Top industry players pointed out that with the stock market showing heightened volatility with a negative bias, retail investors have been shifting their investment choices from small & midcap funds to flexicap funds. Thematic and sectoral funds still remain one of the favourites among investors, they said.

In Feb, small cap schemes net took in Rs 3,722 crore, compared to Rs 5,721 crore in Jan, a 35% drop. Similarly, the corresponding figures for midcap schemes were Rs 3,407 crore and Rs 5,148 crore, a 34% decline. In contrast, flexicap funds net took in Rs 5,104 crore in Feb, compared to Rs 5,698 crore in Jan, a drop of nearly 12%.

The data also showed that gold ETFs continued to attract strong inflows, though the pace had slowed on a monthly basis but jumped on an annual basis. Compared to a net inflow of Rs 3,751 crore in Jan, the Feb figure was at Rs 1,980 crore. The number for Feb 2024 was Rs 997 crore.