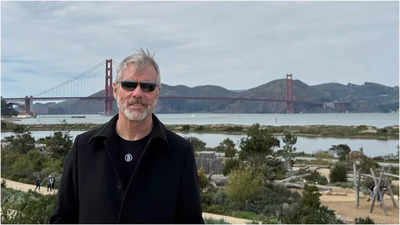

MicroStrategy co-founder Michael Saylor is once again at the center of controversy after posting a provocative remark on X amid Bitcoin’s steep decline.

“Sell a kidney if you must, but keep the Bitcoin,” Saylor wrote as the cryptocurrency plunged below $80,000 on Friday, marking its lowest level since November. The post quickly went viral, drawing both criticism and disbelief.

Why it matters

Bitcoin has tumbled 16% this week, its biggest weekly drop in over two years.

The broader crypto market has lost $500 billion in value, rattled by a $1.5 billion hack and fading confidence in US crypto policies.

Saylor’s comment reignites concerns over reckless financial advice from high-profile crypto advocates.

Backlash on social media

Saylor’s post was met with immediate backlash, with many users accusing him of encouraging desperate measures to support Bitcoin.

“Saylor’s out here trying to have people sell their kidneys so that his investors don’t take both of his and feed him to the fishes,” one X user wrote.

Others initially assumed the post was from a parody account, only to realize it was real. The backlash mirrors the criticism Saylor faced in 2021, when he urged people to mortgage their homes to buy Bitcoin at $57,000—advice that aged poorly when Bitcoin crashed in 2022.

Bitcoin’s crash deepens the fallout

Bitcoin’s plunge is part of a broader market sell-off, with tech stocks also suffering losses. Investors have pulled $2.27 billion from Bitcoin ETFs this week, further dampening sentiment.

Key factors behind the decline

Macroeconomic concerns: Inflationary pressures and Trump’s tariff policies have investors worried about economic growth.

Crypto turmoil: The Bybit hack, the largest crypto theft in history, has shaken confidence.

Bitcoin’s failed breakout: Analysts point to Bitcoin’s inability to break $97,000 since November as a sign that the market’s speculative bubble may be deflating.

What’s next?

Despite Bitcoin’s decline, analysts argue MicroStrategy is still years away from being forced to sell its Bitcoin holdings. However, the latest controversy has added another layer of skepticism around Saylor’s aggressive Bitcoin advocacy.

Joshua Chu, Co-Chair of the Hong Kong Web3 Association, summed it up:

“This price decline shows that positive sentiment from a crypto-friendly administration and high-profile endorsements have run their course. It’s clear Bitcoin is a risk asset, not the inflation hedge it was claimed to be.”

(With inputs from agencies)