Bramesh

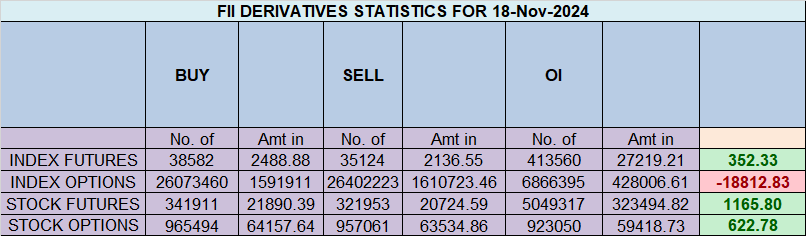

Foreign Institutional Investors (FIIs) displayed a Bearish approach in the Nifty Index Futures market by Shorting 4687 contracts worth ₹275 crores, resulting in a increase of 3463 contracts in the net open interest. FIIs added 4836 long contracts and added 1378 short contracts, indicating a preference for adding long positions and adding short positions. With a net FII long-short ratio of 0.32 , FIIs utilized the market fall to enter long positions and enter short positions in Nifty futures. Clients covered 989 long contracts and covered 6092 short contracts. FII are holding 24 % Long and 76 % Shorts in Index Futures and Clients are holding 69 % Long and 31 % Shorts in Index Futures.

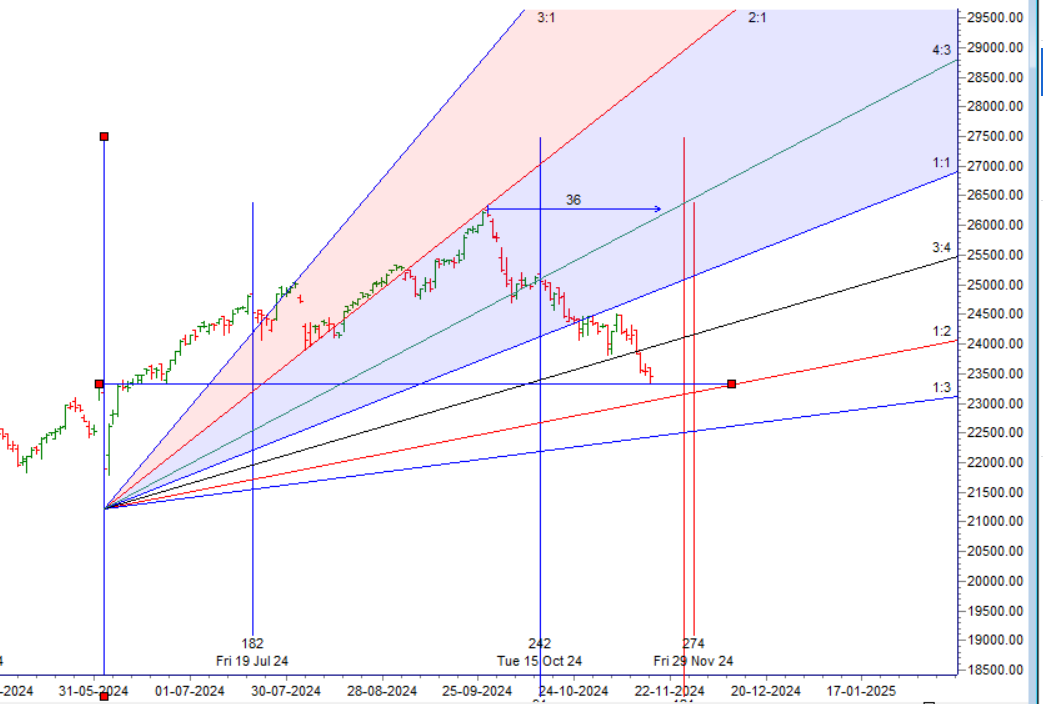

Nifty experienced a waterfall decline today, with the price breaking below 23,777 and closing well below that level, finding support at 23,514 near its 200 DMA. We also observed the impact of the astro cycle as discussed in the video below. The price has broken below the 3×4 Gann angle and is now heading towards the 1×2 angle around 23,200.

Tomorrow, we have the weekly close (as Friday is a trading holiday), marking the 7th week of decline. The second half of tomorrow’s session is crucial, as it could lead to short covering if the price holds above 23,512.

Nifty closed below its 200 DMA today, finding support at the Exit Poll high of 23,338. The low for the day was 23,350, which indicates a breakout retest pattern.

Tomorrow brings significant astrological events, including Mercury Declination and Mercury Opposition Jupiter, both of which have historically led to trend changes, as discussed in the video below. These events could inject volatility and spark directional movement.

For tomorrow, the first 15 minutes’ high and low will be critical for intraday traders to capture the market trend.

Additionally, with Wednesday being a trading holiday, traders are advised to take overnight positions tomorrow with appropriate hedging strategies to manage risks.

Nifty Trade Plan for Positional Trade ,Bulls will get active above 23522 for a move towards 23599/23675. Bears will get active below 23445 for a move towards 23368/23291/23214.

Traders may watch out for potential intraday reversals at 10:11,11:44,12:15,01:53 How to Find and Trade Intraday Reversal Times

Nifty Nov Futures Open Interest Volume stood at 1.21 lakh cr , witnessing a liquidation of 1.3 Lakh contracts. Additionally, the increase in Cost of Carry implies that there was covering of SHORT positions today.

Nifty Advance Decline Ratio at 21:29 and Nifty Rollover Cost is @25178 closed below it.

Nifty Gann Monthly Trade level :24201 close below it.

Nifty has closed below its 200 SMA @ 23546 Trend is Sell on Rise till below 23777.

Nifty options chain shows that the maximum pain point is at 23400 and the put-call ratio (PCR) is at 0.72 Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound.

Nifty 50 Options Chain Analysis

The Nifty 50 options chain indicates that the highest open interest (OI) on the call side is at the 23500 strike, followed by 23700 strikes. On the put side, the highest OI is at the 23400 strike, followed by 23200 strikes. This suggests that the market participants are expecting Nifty 50 to remain range between 23200-23700 levels.

In the cash segment, Foreign Institutional Investors (FII) sold 1403 crores, while Domestic Institutional Investors (DII) bought 2330 crores.

Traders who follow the musical octave trading path may find valuable insights in predicting Nifty’s movements. According to this path, Nifty may follow a path of 23408-24105-24801 This means that traders can take a position and potentially ride the move as Nifty moves through these levels.Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

If there were no goals in football, there would beno one go into the stadium and watch the mere running back and forth. Without goal results, success in football would be unthinkable and not measurable. Most of them play football here, just without goals and without a ball.

For Positional Traders, The Nifty Futures’ Trend Change Level is At 23857 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 23514, Which Acts As An Intraday Trend Change Level.

Nifty Intraday Trading Levels

Buy Above 23480 Tgt 23525, 23580 and 23630 ( Nifty Spot Levels)

Sell Below 23420 Tgt 23385, 23333 and 23300 ( Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Related