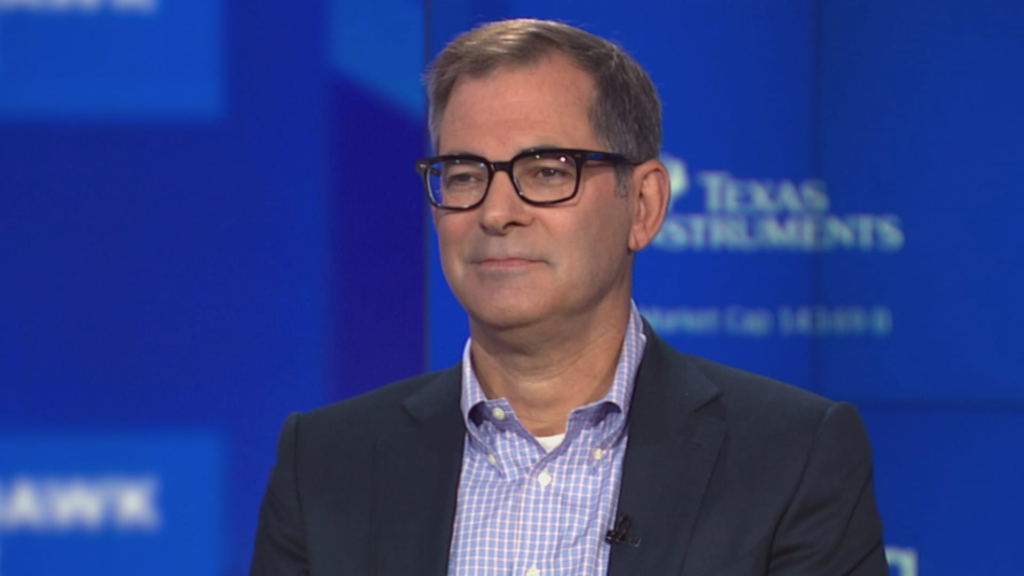

CoreWeave CEO Mike Intrator said Friday that the company’s IPO pricing, which came in below expectations, has to be placed in the larger context of the macroenvironment.

“There’s a lot of headwinds in the macro,” Intrator said on CNBC’s Squawk Box. “And we definitely had to scale or rightsize the transaction for where the buying interest was.”

The company, which provides access to Nvidia graphics processing units for artificial intelligence training and workloads, priced its IPO at $40 a share, below the initial $47 to $55 per share filing. The stock will begin trading on the Nasdaq under the symbol “CRWV.”

The lower price provided enough of a discount to the replacement value that investors could feel comfortable buying, sources familiar with the offering told CNBC’s Leslie Picker. Replacement value is the value of the company’s assets at the present time.

About 10-15 long-only and strategic investors made up the majority of the backing group, the sources said.

“We believe that as the public markets get to know us, get to know how we execute, get to know how we build our infrastructure, get to know how we build our client relationships and the incredible capacity of our solutions, the company will be very successful,” Intrator said.

Nvidia is anchoring the deal with a $250 million order, CNBC reported Thursday.

CoreWeave raised $1.5 billion at the $40 per share price, giving it a non-diluted valuation of around $19 billion.

Intrator said the company will use the money to pay down debt and for expansion.

The company held nearly $8 billion in debt at the end of 2024.

CoreWeave was also bolstered by the recent market action triggered by DeepSeek, which pushed the company to “build bigger” and “build faster,” Intrator said.

“One of the things that’s made us incredibly effective is we take a really long-term view of where this space is going,” he said.

“Our customers are telling us, universally, to continue to build – we cannot keep up with the scale.”

Intrator also addressed administrative issues with a loan last year in which the company faced technical defaults.

The company started to use money from the $7.6 billion loan for scaling in Europe, The Financial Times reported.

Intrator said the company self-reported the “misstep” in its S-1 and quickly addressed it with the lenders.

“Those lenders proceeded to go ahead and continue to lend us hundreds of millions of dollars after all of these issues,” he said.