MUMBAI: When HDFC began offering home loansin the late 1970s, credit was a privilege, accessed cautiously and late in life. A large downpayment was a prerequisite, and only those in their 40s, with years of savings, could typically afford to borrow.Today, credit is accessed much earlier and more casually, with a growing number of Indians starting their credit journey in their mid-20s.

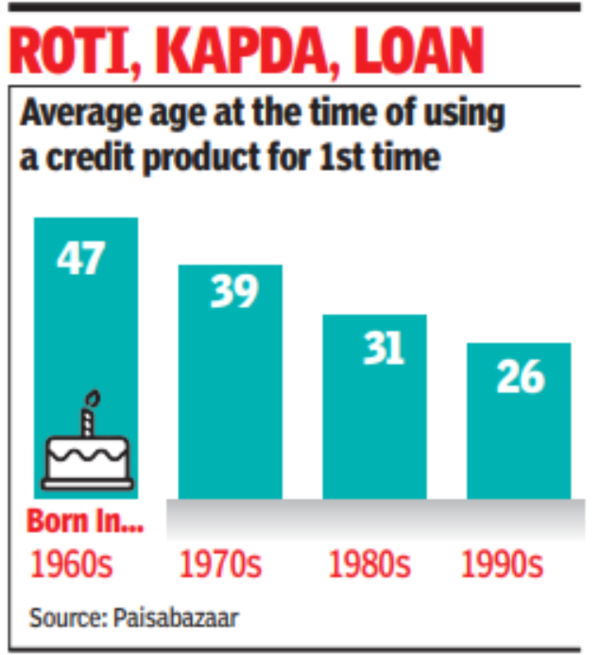

The average age at which Indians avail their first credit product has fallen by 21 years across three generations, a study by Paisabazaar showed. K Cherian Varghese, former chairman of Corporation Bank, who began his banking career five decades ago says that the ability to borrow is directly linked to the size of disposable income. “Personal loans are taken either to finance purchase of some asset like home loan or for consumption. In the 70s, the disposable income was not enough to service the loan EMIs. Today, in many jobs like IT, the employees get a decent salary that allows them to meet all expenses and repay their EMIs,” said Varghese. He adds that today banks have pre-approved many corporate employers and are willing to provide a suite of credit products to their employees making credit much more accessible.

While the credit bureau made it easier for lenders to identify delinquents, the Jan Dhan-Aadhaar-Mobile trinity made it easier to keep track of borrowers. The study, which is based on the credit behaviour of over 10 million consumers, showed that those born in the 1960s began borrowing at 47, largely through secured loans like mortgages. In contrast, individuals born in the 1990s typically enter the credit ecosystem by the age of 25-28, often through unsecured products such as credit cards, personal loans, and consumer durable loans.

This shift reflects the broader trend of easier access to credit and a changing consumer mindset – one that values instant gratification over prolonged savings. While the first credit card in India was launched by Central Bank with Mastercard in the early 80s, it was a very highly restricted product. The card was offered largely to tax-paying high earners. It wasn’t until Citi, SBI and ICICI started offering cards to a wider audience that cards picked up.

The study traces how the entry point into the credit system has evolved. For those born in the 1960s, home loans were the first credit product. For the 1970s and 1980s cohorts, auto loans became the preferred starting point, availed at average ages of 39 and 31, respectively. The average age for a first-time home loan borrower has declined from 41 (for those born in the 1970s) to 28 (for the 1990s-born).