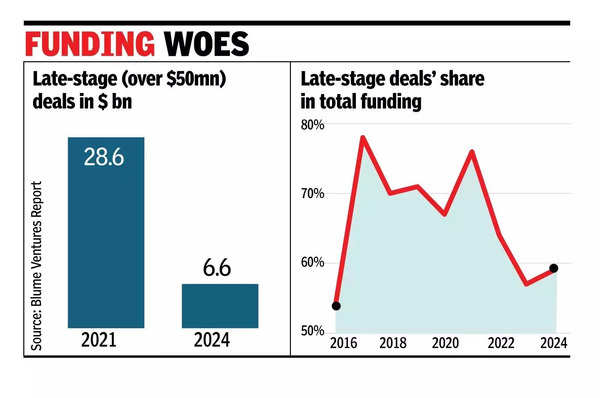

MUMBAI: The share of late-stage deals in total startup funding has dropped to under 60% through 2024 and 2023, inching closer to levels seen in 2016 when the contribution of big-sized cheques–typically over $50 million, stood at 54%. This is a far cry from the past few years when large deals easily made over 70% of total investments into startups-in 2021 when funding hit a peak amid the Covid-led surge, touching close to $40 billion, the share of late-stage deals stood at 76%, a report by Blume Ventures showed. Funding rounds with a size of over $50 million comprised the bulk of the share of late-stage investments for more than five years now.

Following the global tech downturn and a broader market correction, late stage funding into US startups have seen a sharp revival, thanks to the AI boom. AI funding alone made up about $97 billion of total large deals worth $120 billion in the market. In India, the flow of large-deals have been rather tepid except a few outlier funding rounds like that of quick commerce startup Zepto which bagged a little over $1 billion in capital from investors in 2024. “A thriving venture market like US has about 70%-75% late stage funding as more companies keep growing and require more growth capital,” analysts at the VC firm said.

In all, Indian startups garnered $11.2 billion in funding in 2024 of which late stage deals accounted for $6.6 billion, a steep drop from $28.6 billion seen at its 2021 peak. Global investment giants like SoftBank and Tiger Global have been going slow on new big India deals, leading to a drop in late-stage funding, TOI had reported. Even the time taken to close early stage funding rounds is getting longer.