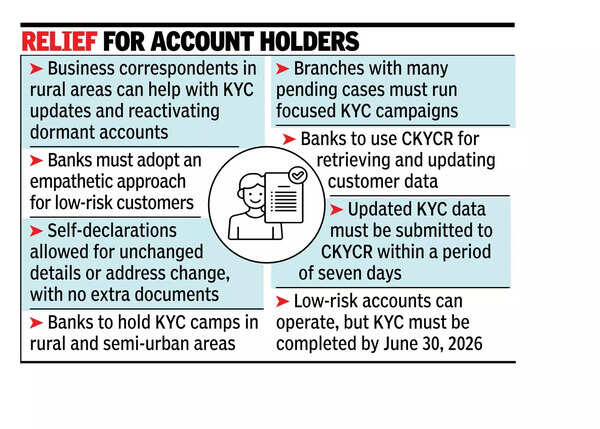

MUMBAI: RBI has eased KYC norms to simplify compliance and to make it easier for individuals to access long-dormant bank accounts and unclaimed deposits, many of which have remained untouched for over 10 years. The move, announced through a circular on June 12, aims to ensure that anti-money laundering rules do not hinder rightful account holders from accessing their savings particularly in accounts opened to receive government benefits.RBI has asked banks to give three advance intimations prior to the due date of periodic updation of KYC and at least one intimation must be by letter. In the past customers have complained that digital alerts have been missed and they only come to know when they are not able to transact on their account. The central bank has also asked banks to allow KYC updates at any branch, irrespective of where the account was opened. It has also permitted the use of Aadhaar OTP and video-based customer identification for periodic KYC updates. Business correspondents, especially in rural areas, can now assist customers with reactivating inoperative accounts and completing KYC requirements.

According to RBI, banks must take an ’empathetic view’ when dealing with low-risk customers seeking to update their KYC or reactivate dormant accounts. Customers with no changes in personal information, or only a change of address, can now submit self-declarations through digital or offline channels, without the need for additional documents.Banks have been directed to organise KYC update camps, especially in rural and semi-urban areas, and to launch focused campaigns in branches with a high number of pending updates. These efforts are particularly targeted at accounts linked to direct benefit transfers and Jan Dhan accounts, where KYC compliance has lagged.According to Anand Bajaj, founder MD & CEO of PayNeary, allowing business correspondents to collect self-declarations and assist with biometric-based e-KYC, will allow banks to efficiently reach customers in areas with limited branches.