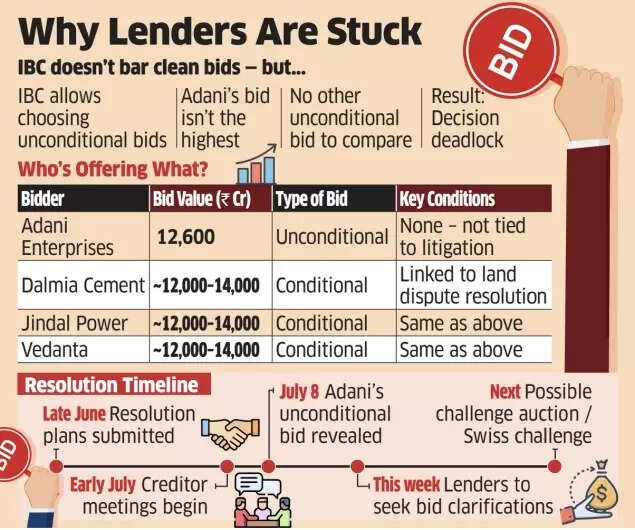

Lenders of JP Associates appear to be in a dilemma regarding Adani Enterprises’ unconditional bid for the company. The challenge for lenders lies in assessing comparable offers, as other potential buyers have submitted proposals with specific conditions attached, according to an ET report.The situation has reached an impasse because Adani’s proposal, despite being unconditional, is not the highest offer available. The resolution to this issue would require additional unconditional bids, the report said.The insolvency and bankruptcy code (IBC) allows lenders to select an unconditional offer when no similar bids exist.As reported by the financial daily earlier, Adani Enterprises has offered Rs 12,600 crore for JP Associates. This proposal stands out because the payment structure is not contingent upon future uncertainties, such as potential legal complications.

Why Lenders Are Stuck

Companies like Dalmia Cement Bharat, Jindal Power and Vedanta have submitted proposals to acquire the financially troubled JP Associates. According to sources quoted in the report, their proposals include stipulations related to settling a land dispute.The majority of bidders have submitted proposals ranging between Rs 12,000 crore and Rs 14,000 crore.This week, creditors are expected to request clarification from competing bidders regarding the conditions attached to their proposals, according to informed individuals.Upon resolution of the impasse, creditors are considering implementing either an electronic challenge auction or a Swiss challenge method, where the highest bid establishes the base price for subsequent bidding.The resolution proposals for Jaiprakash Associates were submitted in the last week of June. Since then, the company’s creditors have conducted two meetings to evaluate these proposals.