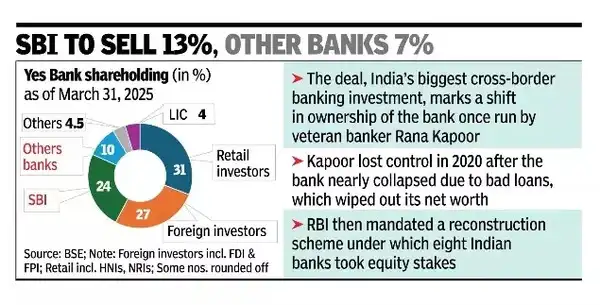

MUMBAI: Five years after a group of Indian lenders led by SBI stepped in to rescue Yes Bank, Japan’s Sumitomo Mitsui Banking Corporation (SMBC) will acquire a 20% stake in the private lender for Rs 13,483 crore, making it the largest shareholder. The deal, India’s biggest cross-border banking investment, marks a shift in ownership of the bank once run by veteran banker Rana Kapoor. Kapoor lost control in 2020 after the bank nearly collapsed due to bad loans, which wiped out its net worth. RBI then mandated a reconstruction scheme under which eight Indian banks took equity stakes.SBI will now sell a 13.2% stake, cutting its holding to just over 10%. ICICI Bank, HDFC Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Federal Bank, and Bandhan Bank will offload a combined 6.8%. The deal is priced at Rs 21.5 per share, above the recent market price and more than double what the rescuing banks invested.

SMBC, a unit of Japan’s second-largest bank by assets, will become Yes Bank’s anchor investor after securing regulatory and shareholder approvals. The deal may reshape the bank’s strategy and comes amid SMBC’s broader push into Asia. Its parent, Sumitomo Mitsui Financial Group, has $2 trillion in assets and recently took full ownership of its Indian NBFC arm, SMFG India Credit (formerly Fullerton).SMFG sees India as a counterweight to Japan’s ageing population and low growth. The firm is betting on India’s demographics and macroeconomic momentum.On May 6, after reports of SMBC’s interest, Yes Bank denied knowledge of any unannounced developments, causing shares to erase a 10% gain. The stock again surged 10% on Friday ahead of the announcement.Banking industry observers are waiting to see if SMBC takes the wholly-owned subsidiary (WoS) route in Yes Bank. In the past, both DBS and State Bank of Mauritius used the WoS route to acquire a local banking licence. Most large foreign banks operate as branches and need permission to open new ones. SMBC will also have to deal with a bank that has a bloated equity base, following massive capital infusions.