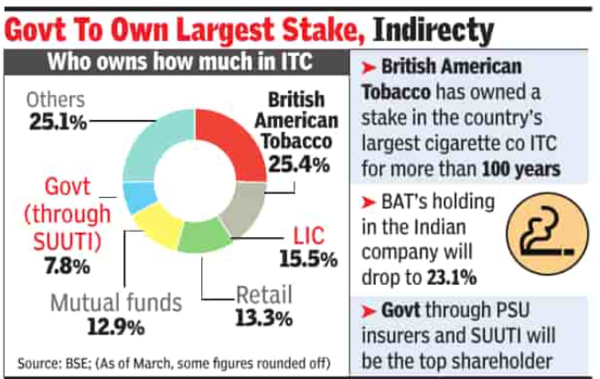

MUMBAI: British American Tobacco, one of the world’s largest tobacco products companies that is also the biggest shareholder in tobacco-to-FMCG major ITC, is selling about 2.3% stake in the Indian conglomerate, aiming to garner over Rs 11,600 crore ($1.4 billion). In March last year, London-listed BAT had pocketed about Rs 17,500 crore ($2.1 billion) by offloading 3.5% stake in ITC in one of the biggest block deals ever in India. After the latest block deal, BAT’s holding in the Indian company will drop to 23.1% from 25.4%. The stake sale, BAT said, will allow it increased financial flexibility as it “delivers on its commitment to invest in transformation, deleverage and sustainable shareholder returns”

“We continue to view ITC as a core strategic component of our global footprint as we partner on business opportunities in India,” Tadeu Marroco, chief executive of BAT said in a statement. Tobacco Manufacturers (India), a BAT affiliate, is divesting up to 290 million shares, or approximately 2.3% of ITC’s total shareholding, through a bulk sale on the Indian exchanges. The offer, managed by Goldman Sachs and Citigroup, is entirely secondary and priced at a floor of Rs 400 per share – a 7.8% discount to ITC’s closing price of Rs 433.9 on May 27 (which translates into 6.5% post dividend). The transaction size is estimated at Rs 11,613 crore (around $1.4 billion). Investors buying into the sale will not be entitled to the recently announced dividend of Rs 7.9 per share, as the stock goes ex-dividend on May 28 and operates on a T+1 settlement cycle.BAT had earlier indicated that it was important for the company to retain 25% shareholding in ITC as it provides veto rights and influence on the board. On Tuesday, BAT said that the proceeds from the proposed sale will be used to “progress within the target 2-2.5x adjusted net debt/adjusted EBITDA leverage corridor (adjusted for Canada) by the end of 2026 and to continue our sustainable buyback programme by enabling an intended 200 million pound increase in the share buyback to a total of 1.1 billion pounds in 2025.” Earlier this year, ITC’s demerged hotel business listed as a separate company after shares were issued to existing ITC shareholders. BAT has already announced its intent to exit the hotel arm.After the sale, govt through public sector insurers and SUUTI will be the largest shareholding group in ITC with 26.5% stake.