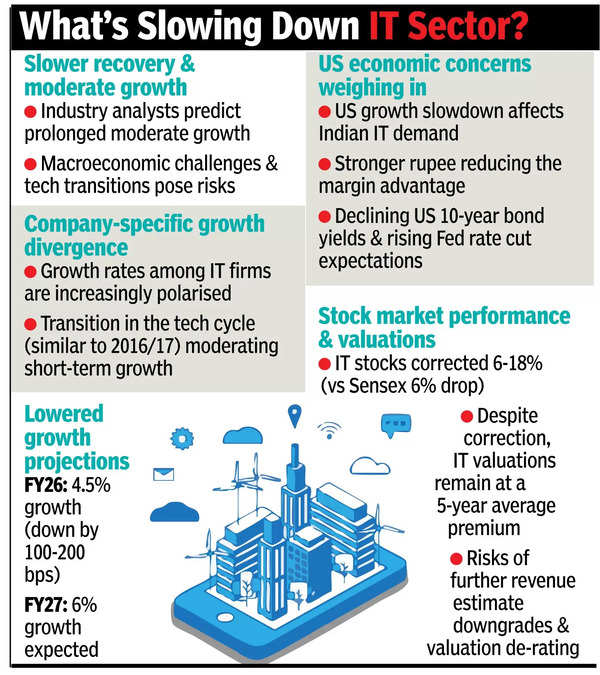

BENGALURU: The IT sector is trudging in the slow lane, operating at a lacklustre pace. Industry analysts forecast a slower pace of recovery with moderate growth for a longer period, even as the IT sector faces potential challenges stemming from the macro-economic environment and technology transition, increasing risks to revenue growth. This presents a case for a weak multiplier effect, leading to subdued growth for Indian IT firms.

Analysts have also observed that growth rates are becoming polarised among various players, primarily influenced by company-specific developments. “Change in tech cycle is likely to create a transition phase for tech services companies (like 2016/17), causing growth to moderate in short term. We are lowering our dollar revenue growth forecasts by 100-200 bps and expect growth of 4.5% in FY26 and 6% in FY27 for large-cap IT companies,” analysts at Morgan Stanley wrote in a recent report.

Jeffries said it has changed stance on IT sector to underweight (from overweight) due to rising growth worries in the US. “Weakened US growth outlook is reflected in US 10-year bond yield decline and higher Fed rate cut expectations. Moreover, with the US Dollar Index now down 4.2% in one month, the pressure on the Rupee may reduce going forward, which was a margin tailwind for IT companies,” a note said.

Morgan Stanley said IT stocks have corrected by 6%-18% (vs sensex 6%). “Despite drop, relative valuations vs sensex are still at five-year average (14.5% premium vs 5-year average of 14.4%). We see risks to consensus revenue estimates and a potential de-rating risk for multiples back to long-term average.”

Morgan Stanley said tech shifts would open up newer opportunities, but growth will slw down in initial transition period. Its report highlighted examples of new addressable market opportunities, such as modernisation of a legacy technology stack of applications using Gen AI technology, data and analytics work related to both structured and unstructured data and automation of basic-level jobs creating efficiency benefits such as contact centre operations.