MUMBAI: Dalal Street on Monday weathered the fallout of US involvement in the Israel-Iran conflict.As a reaction to US bombing of Iran’s nuclear sites early on Sunday, the sensex opened deep in the red but soon stabilised as it became clear that Iran’s response to the attack would not be immediate. In early trades, the sensex was down over 800 points, but recovered through the session to close 511 points lower at 81,897 points. On the NSE, Nifty treaded a similar path and closed 141 points lower, below the 25,000 mark.The rise in tension in West Asia, spike in crude oil prices, pressure on the rupee and selling by foreign funds combined to pull the leading indices down, market analysts and brokers said.

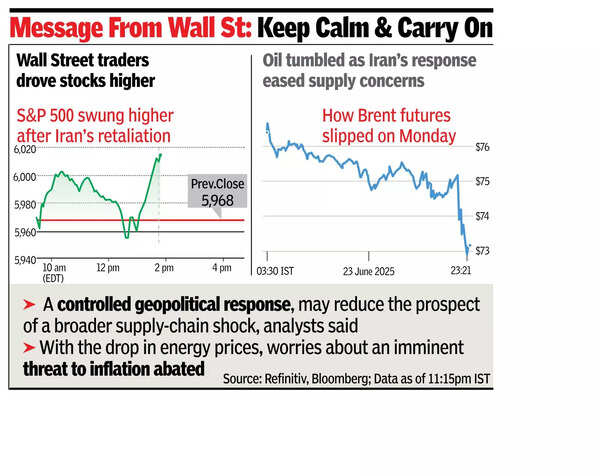

According to Vinod Nair of Geojit Investments, market players bought stocks in anticipation of easing West Asia tensions last week, following US’ announcement of a two-week window to deliberate its involvement in the conflict. “However, the unexpected US airstrike on Iran’s nuclear facilities over the weekend disrupted those expectations, triggering a sharp rise in crude oil prices and leading to consolidation in the domestic equity market. Despite the initial setback, the market recovered most of its losses, supported by gains in capital goods and metal stocks, as fears of an immediate oil supply disruption remained low.”The day’s session was led by foreign funds that recorded a net outflow of Rs 1,875 crore, BSE data showed. At the same time, domestic funds were net buyers at Rs 5,592 crore.The selling was concentrated in large cap stocks with midcap and smallcap stocks mostly closing with gains. BSE’s midcap index closed 0.2% higher while the smallcap index was up 0.6% compared to sensex’s 0.6% loss.As a result, combined wealth of investors went up by about Rs 10,000 crore to Rs 447.8 lakh crore, official data showed. For Tuesday, market players expect volatility to continue till there’s some clarity about the tension in West Asia, they said.