Mid-cap and small-cap stocks back on track? The mid-cap and small-cap stocks’ recent upward movement suggests potential for further upside. Technical indicators in the short term suggest their indices could rise by an additional 5%, following a similar increase over the past three trading sessions, says an ET report. However, market observers remain uncertain about the sustainability of this recovery after the significant decline over the previous six months.

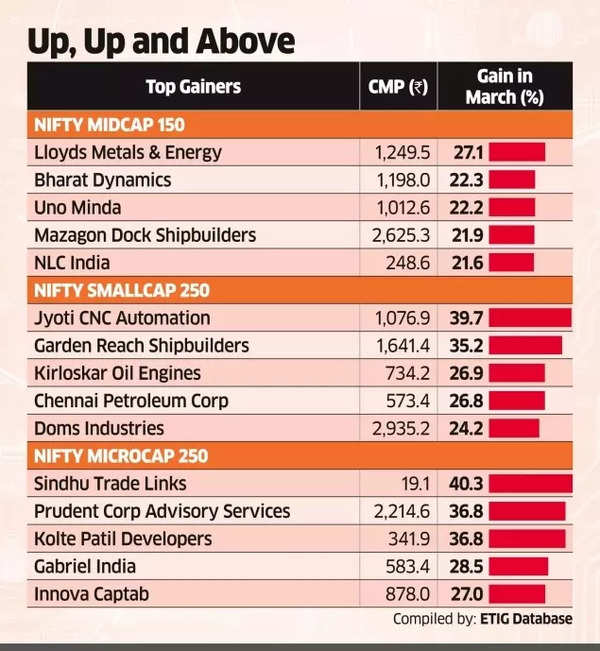

The Nifty Midcap 150 index recorded a 2.37% increase on Wednesday, whilst the Small-cap 250 advanced by 2% and Microcap 250 showed a 2.2% gain at closing. These three indices have risen between 4.7% and 5.2% during the past three days, surpassing the Nifty 50’s benchmark increase of 2.25%.

The domestic market’s anxiety has diminished recently, influenced by improved global sentiment and reduced selling by foreign investors.

Mid and small cap stocks rise

“With the recent fall in the dollar index from 110 to 103 levels, and FIIs covering shorts and turning buyers on Tuesday, we have seen some pullback move in the market,” said Ruchit Jain, vice president at Motilal Oswal Financial Services.

“The entire market breadth has turned positive, and we have seen the small-cap and mid-cap indices close above their 20-Day Simple Moving Average, which is an important short-term market indicator.”

Jain anticipates a short-term increase of 3-5% in these indices.

Between September 27, when the market decline began, and March 3 – marking the start of the current recovery, the mid-cap 150 index decreased by 20.5%, whilst the small-cap 250 fell by 25.4% and the micro-cap 250 experienced a 25% reduction.

Indian equity benchmark indices, BSE Sensex and Nifty50, have also recovered from their recent lows in the past few sessions. In the past 5 trading sessions, both Sensex and Nifty have risen over 2%. However, they are still significantly down from their lifetime highs in September 2024.