MUMBAI: IndusInd Bank shares plunged 27% on Tuesday to Rs 656, erasing Rs 19,000 crore in market value — the sharpest drop in its history. The fall followed the bank’s disclosure of Rs 2,100 crore derivatives accounting discrepancy, cutting net worth by 2.4%. The stock hit its lowest since Nov 2020, making it Nifty 50’s worst performer in a year.

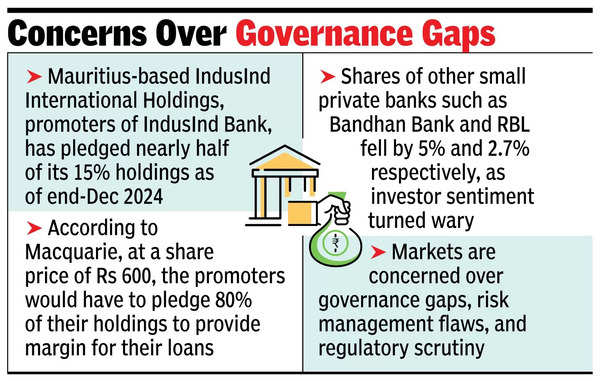

Markets feared that a sharp fall in the price of the bank shares would trigger margin calls for the promoters — Mauritius-based IndusInd International Holdings — who have pledged nearly half their 15% holdings as of end-Dec 2024. Shares of other small private banks — Bandhan Bank and RBL fell by 5% and 2.7% respectively, as investor sentiment turned wary.

Concerns over governance gaps

The bank’s MD and CEO Sumant Kathpalia in an analyst call on Monday evening said that the post-tax impact of the derivative losses would be around Rs 1,530 crore (2.35% of bank’s net worth). According to Kathpalia, the bank’s capital adequacy and profits were enough to absorb the hit. However, markets were concerned over governance gaps, risk management flaws, and regulatory scrutiny.

According to a research report by Macquarie, IIHL holds nearly 15.1% stake in IndusInd Bank, with around 7.7% of total outstanding shares and just under 50.9% of their stake pledged. The loan, initially Rs 3,088 crore in 2021, was topped up on Dec 20, 2024, raising the pledged stake’s value from Rs 4,967crore to Rs 5,554 crore. According to Macquarie, at a share price of Rs 600, the promoters would have to pledge 80% of their holdings to provide margin for their loans.

“In our view, clearly there is a significant trust deficit and speaking to investors, they are waiting for change in management to restore credibility and trust here which is going to be a long process. So unfortunately now earnings recovery won’t matter as investors don’t trust the balance sheet, internal processes and compliance,” said Suresh Ganapathy of Macquarie in his report.

IndusInd Bank, meanwhile, has hired PwC India for an independent review, which is expected by April 2025.