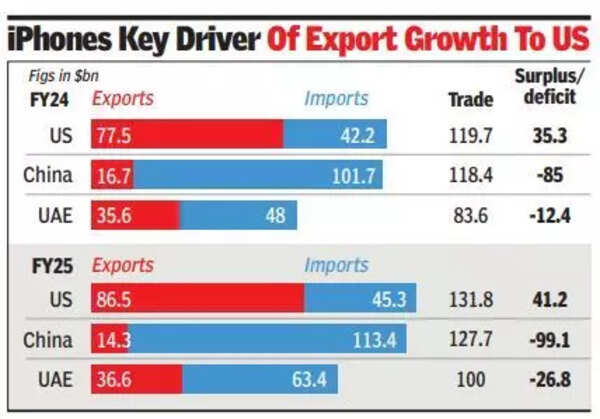

NEW DELHI: The top three countries with which India trades remained unchanged, with the US on top, followed by China. However, the trends were quite different. During the last fiscal year, with the US, India saw its exports rise by 11.6% to $86.5 billion, while imports rose at a slower pace of 7.4% to $45.3 billion, resulting in a higher trade surplus of $41 billion – not the best news when Donald Trump is seeking to narrow it.

In contrast, India’s trade deficit with China neared the $100 billion mark, due to a fall in exports to $14.2 billion, while imports jumped 11.5% on an already high base to close the year at $113.5 billion. In fact, China is now India’s fifth biggest export destination, slipping one place as the UK rose to number four, provisional data released by the commerce department showed.

A bulk of the fall in exports was due to lower ore exports, particularly iron. According to the latest disaggregated data available from April to Jan 2024-25, the export of ores almost halved to $1.5 billion. Although the level of imports was lower, similar trends were seen in the case of iron and steel and aluminium. The value of cotton shipments from India also dropped from $725 million during April-Jan 2023-24 to $192 million during the first 10 months of the last financial year.

In case of the US, a major chunk of the growth in exports was due to more smartphones, particularly iPhones, making their way into Apple stores. The growth in Indian smartphone production also meant that smartphone imports from China crashed 70% to $252 million. However, electronic components jumped.

When it came to other imports, Chinese-made computers were among the biggest items in the basket, while machinery was huge – from those going to air conditioners to those used for embroidery. Surprisingly, during April to Jan, the import of photovoltaic cells dropped around 20% to $2.4 billion, while lithium-ion imports were marginally lower at $1.8 billion.