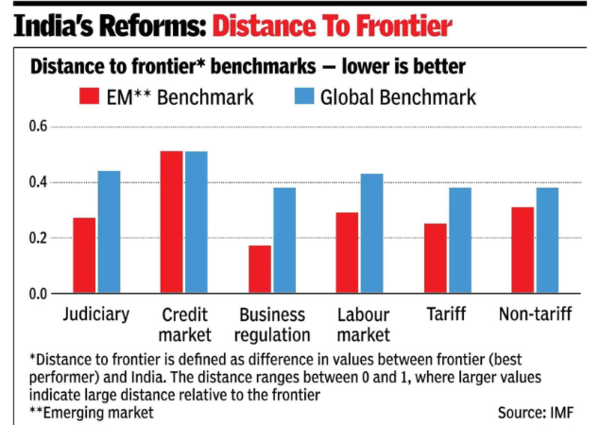

NEW DELHI: IMF has said that India appears to be on course for sustained growth in the medium-term on the back of multiple factors but underlined the need for crucial structural reforms, including in judiciary, tariffs, labour regulation, along with a stable regulatory regime.

The latest review based on the annual consultation has also called for GST simplification – preferably moving to a single rate of 14%, along with a cut in excise duty on fuel and broadening of the income tax base. “…India’s financial sector health, strengthened corporate balance sheets and strong foundation in digital public infrastructure underscore India’s potential for sustained medium-term growth and continued social welfare gains. Risks to the economic outlook are tilted to the downside,” IMF said.

While calling for higher R&D push, it flagged several other reform moves that were required in the country: Other priorities include pursuing agricultural, land, governance, and judicial reforms; strengthening of education, skilling, public health, and social safety nets; reducing the public sector footprint in credit markets; and implementation of climate policies.”

It also sought a review of the bilateral investment treaty, something that was announced by FM Nirmala Sitharaman in the budget, and suggested more trade deals, going beyond bilateral agreements. It underlined the need for deeper reforms, arguing that PLIs would not be sufficient to create jobs needed to absorb the growing labour force. “In addition, the fiscal costs per job created are substantial,” it said, pointing to the scheme that has attracted some top global, such as Apple’s suppliers to invest.