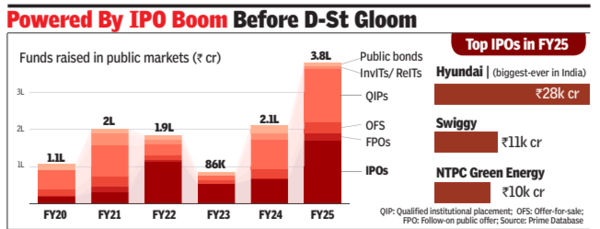

MUMBAI: Indian companies raised a record Rs 3.8 lakh crore in financial year 2024-25 by selling stocks through primary and secondary issuances like IPOs and qualified institutional placements (QIPs), apart from debt. (see graphic)

If one adds the Rs 16,167 crore raised through rights offers, the total would nearly touch the Rs 3.9-lakh-crore mark, also an all-time record, a report by analytics firm Prime Database showed. At Rs 3.7 lakh crore, equity fund-raising in FY25 was double the previous high of Rs 1.9 lakh crore raised during FY24 and FY21.

FY25 saw three mega IPOs, of Rs 10,000 crore or more: Automobile major Hyundai Motor raised Rs 27,859 crore (the largest ever in India), Swiggy raised Rs 11,327 crore while state-owned renewable energy giant NTPC Green Energy raised Rs 10,000 crore.

The year also saw Rs 11.1 lakh crore raised through debt instruments, which was also an all-time high level. Most fund-raises in the fixed income side were through the private placement route and just Rs 8,044 crore was raised through public offers of bonds.

According to industry analysts and merchant bankers, a good secondary market that offered strong listing gains to IPO investors drew in more such investors that in turn helped a large number of companies to go public. In addition, institutional support and ‘right’ pricing by merchant bankers also helped strong fund-raising momentum through the equity route.

The response to IPOs was buoyed by strong listing performance, Prime Database Group MD Pranav Haldea said. The response to IPOs was buoyed by strong listing performance. In FY25, average listing gain (based on closing price on the listing date) increased slightly to 30% from 29% in FY24. As many as 55 main board IPOs out of 78 that closed in FY25, gave a return of over 10%, Haldea said.

The IPO momentum, however, has slowed down substantially in the last three months, mainly because of bearish sentiment in the secondary market, combined with strong volatility. For a change, for the first time since March 2022, no company was listed on the main board of any of the two leading bourses this month, industry data showed.