MUMBAI: The banking sector’s Q4 consolidated net profit has crossed Rs 1 lakh crore for the first time. Public sector and private banks together posted a net profit of Rs 1,00,178 crore in Q4FY25, up 9% from Rs 91,829 crore in the year-ago quarter.Bank earnings accounted for over a third of listed companies’ profits, which stood at around Rs 2.93 lakh crore. This growth came despite a squeeze in net interest margins, as lending rates fell following RBI’s Feb rate cut, while deposit costs stayed high. Lenders, however, offset the impact through treasury gains and recoveries from bad loans.

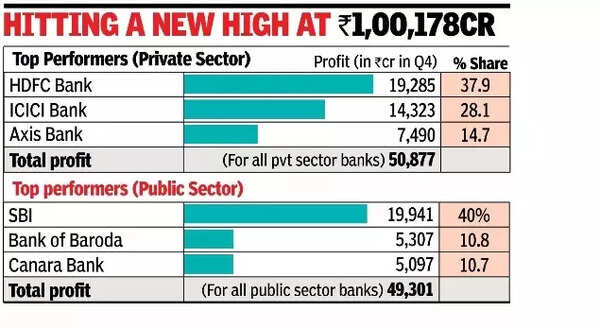

The rate cut and RBI’s liquidity infusion brought down bond yields, resulting in mark-to-market gains. As bond yields fall, the value of older bonds with higher coupons rises. Banks booked profits by selling part of their government bond holdings, either to other banks or to RBI, which conducted open market repurchases.Public sector banks benefited more from the decline in bond yields as nearly a fourth of their deposits are invested in government securities. Their Q4FY25 net profit rose 13% to Rs 49,301 crore from Rs 43,615 crore, including IDBI Bank, which, while classified as a private lender, is largely owned by LIC and the govt.Private sector banks posted a relatively modest 5.2% rise in net profit to Rs 50,877 crore from Rs 48,214 crore. These figures exclude IndusInd Bank, which is expected to take a significant earnings hit due to provisions of nearly Rs 2,000 crore on derivative losses. Analysts warn that profits could turn negative if further provisioning is needed for its microfinance book.Among PSU banks, four lenders-SBI (40%), Bank of Baroda (10.8%), Canara Bank (10.3%), Union Bank (10.1%) and PNB (9.4%)-contributed over 80% of the profits. SBI was the only PSU bank to report a decline, with net profit falling 8% to Rs 19,941 crore. In the private sector, profits were even more concentrated. HDFC Bank accounted for 37.9%, ICICI Bank 28.1%, and Axis Bank 14.7% of the total.Analysts say that the banking sector’s earning growth directly corresponds to the growth in gross domestic product. While banks do face margin pressure when interest rates dip, it is usually compensated for through increased demand, an improvement in trading profits and lower provisions.