MUMBAI: IL&FS Group has announced a Rs 5,000 crore payout to creditors of the bankrupt infrastructure conglomerate as part of its ongoing debt resolution efforts. The distribution consists of Rs 3,500 crore in Infrastructure Investment Trust (InvIT) units and Rs 1,500 crore in cash, primarily targeting large creditors and public funds. This payout is being led by three holding companies-IL&FS, IL&FS Financial Services (IFIN), and IL&FS Transportation Networks (ITNL)-which hold the majority of the group’s debt.

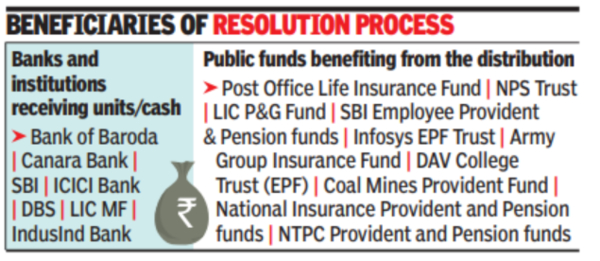

Banks and institutions receiving units/cash include Bank of Baroda, Canara Bank, SBI, ICICI Bank, DBS, LIC MF, and IndusInd Bank. Public funds benefiting from the distribution include Post Office Life Insurance Fund, NPS Trust, LIC P&G Fund, SBI Employee Provident & Pension funds, Infosys EPF Trust, Army Group Insurance Fund, DAV College Trust (EPF), Coal Mines Provident Fund, National Insurance Provident and Pension funds, and NTPC Provident and Pension funds.

The InvIT units are linked to six road assets under Roadstar Infra Investment Trust, which holds an enterprise valuation of Rs 8,576 crore. These assets include MBEL, SBHL, PSRDCL, BAEL, TRDCL, and HREL. The units are being distributed through a private placement, followed by a listing in accordance with SEBI regulations. The distribution will improve recovery rates for creditors of these assets, including IL&FS, IFIN, ITNL, and Sabarmati Capital One. Once completed, the payout will reduce IL&FS Group’s outstanding debt to around Rs 43,000 crore, or over 70% of its total debt resolution target of Rs 61,000 crore.

Including past payouts, the total interim distribution will exceed Rs 17,000 crore, which includes the Rs 3,500 crore in InvIT units. “This payout marks an important milestone for the Group,” said Nand Kishore, CMD of IL&FS Group.

The record date for the allocation of InvIT units and cash is set for Feb 17, 2025.