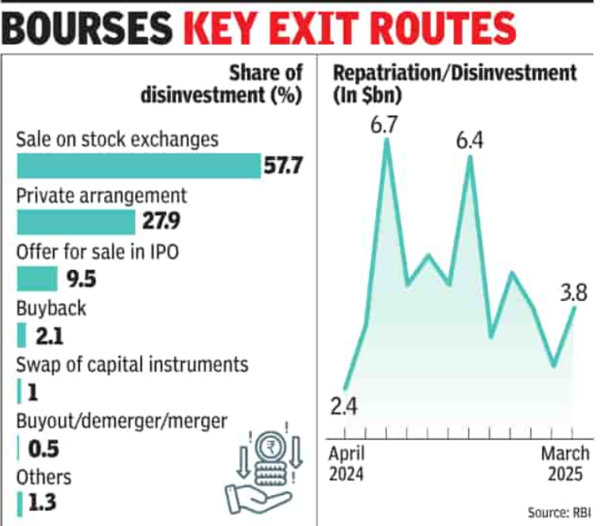

NEW DELHI: The surge in repatriation or disinvestment by investors was driven by overseas players seeking to cash in on higher valuations in India. They exited through IPOs, stock market sales, and “private arrangements,” with Singtel’s share sale in Bharti Airtel, IndiGo co-founder Rakesh Gangwal’s sale through block deals in IndiGo parent Interglobe, and Hyundai’s dilution through the public issue in its Indian arm being the top contributors.Official data accessed by TOI showed that during the last financial year, 95% of the disinvestment or repatriation was related to these three categories, with two-thirds of all divestments happening through the stock market route. Overall, 58% of the remittances were linked to stock market transactions, while another 28% were on account of private arrangements, including private placements and preferential allotments.

As Gangwal sold more shares in Interglobe and BAT announced a fresh sale in ITC, the trend has continued into the current fiscal year as well. The two transactions in as many days between them garnered a little under Rs 25,000 crore (around $2.9 billion).Latest data released by RBI pegged disinvestment of shares in Indian entities during the last financial year at over $51 billion. Along with outward FDI of $29 billion, this resulted in net FDI inflows of just under $400 million, 96% lower than the previous year. In its monthly Bulletin, RBI described it as “a sign of a mature market where foreign investors can enter and exit smoothly, reflecting positively on the Indian economy.“Govt sources, however, said that too much should not be read into the numbers as foreign players, particularly private equity investors, were exiting a part of their investment in domestic companies at a premium. Apart from the Hyundai parent, investors in Swiggy and rival Eternal (formerly Zomato) also decided to book profits on their investments in the two food delivery companies.When it comes to outward FDI, the Mittals of Bharti Group acquired a stake in BT Group in the UK, apart from several other companies seeking to tap into opportunities overseas. “That Indian overseas direct investment increased nearly by $12.5 billion during FY25, even as uncertainty reigned in the world, warrants attention, especially given their cautious attitude towards domestic investment,” the finance ministry’s monthly economic report said.