MUMBAI: Health insurance premium costs have surged forcing some policyholders to either downgrade or drop out of their cover. 1 in 10 policyholders has missed out on renewals in this financial year. About 10% policyholders have seen their renewal costs rise by 30% or more this year – only half of them paid the full premium.

Why are premiums soaring? Insurers say a worsening claims ratio (the percentage of claims to total premium collected) is behind the hikes.

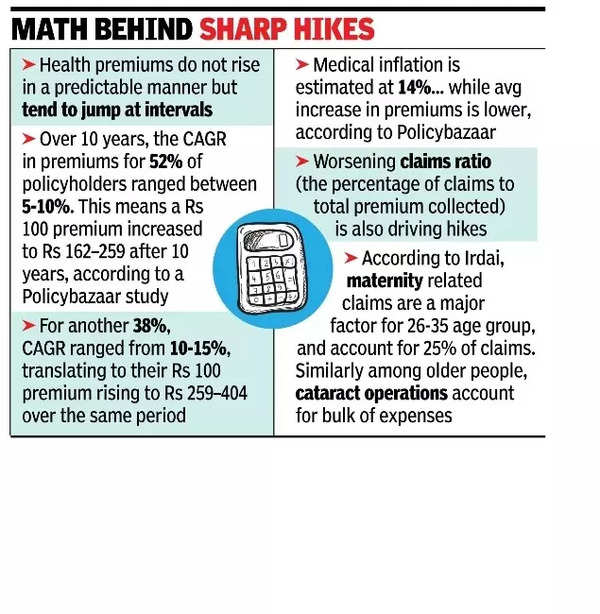

The reason why a section of policyholders see sharp hikes is that health premiums do not rise in a steady, predictable manner but tend to jump at intervals. Insurers typically adjust their rate schedules every three years to account for medical inflation – the rising cost of treatments. Premiums also increase with age, with sharper hikes in later years reflecting higher claims in older age groups.

Over the last 10 years, the compound annual growth rate (CAGR) in premiums ranged between 5-10% for 52% of policyholders. This means that for more than half of them, a Rs 100 premium increased to Rs 162-259 after 10 years.

For another 38%, CAGR in premiums ranged from 10-15%, translating to their Rs 100 premium rising to Rs 259-404 over the same period. However, 3% of policyholders saw their premiums rise with a CAGR of 15-30%.

“The percentage of people who saw a very large price increase is very small. You have to look at what is happening in the context of medical inflation, which is close to 14%, while the average increase in premiums is much lower,” said Amit Chhabra, chief business officer general insurance at Policybazaar. He adds that the 90% renewal is a 10% improvement from the previous year and the renewal ratio is trending upwards.

A study by Policybazaar provides insights into India’s evolving health insurance market, highlighting rising premiums, consumer strategies to mitigate costs, and the industry’s response to increasing medical inflation. While some policyholders face sharp premium hikes, most are finding ways to manage expenses through new plan structures and cost-saving measures.

“If there is a price increase, and I don’t want to absorb that increase, then as a customer, I have the option to move to a slightly lower variant, which brings down the premium. Many people are also opting for deductibles when renewing their policies to reduce costs,” said Chhabra. Besides medical inflation, and emergence of new tech, there is also widening of the scope of cover in health insurance.