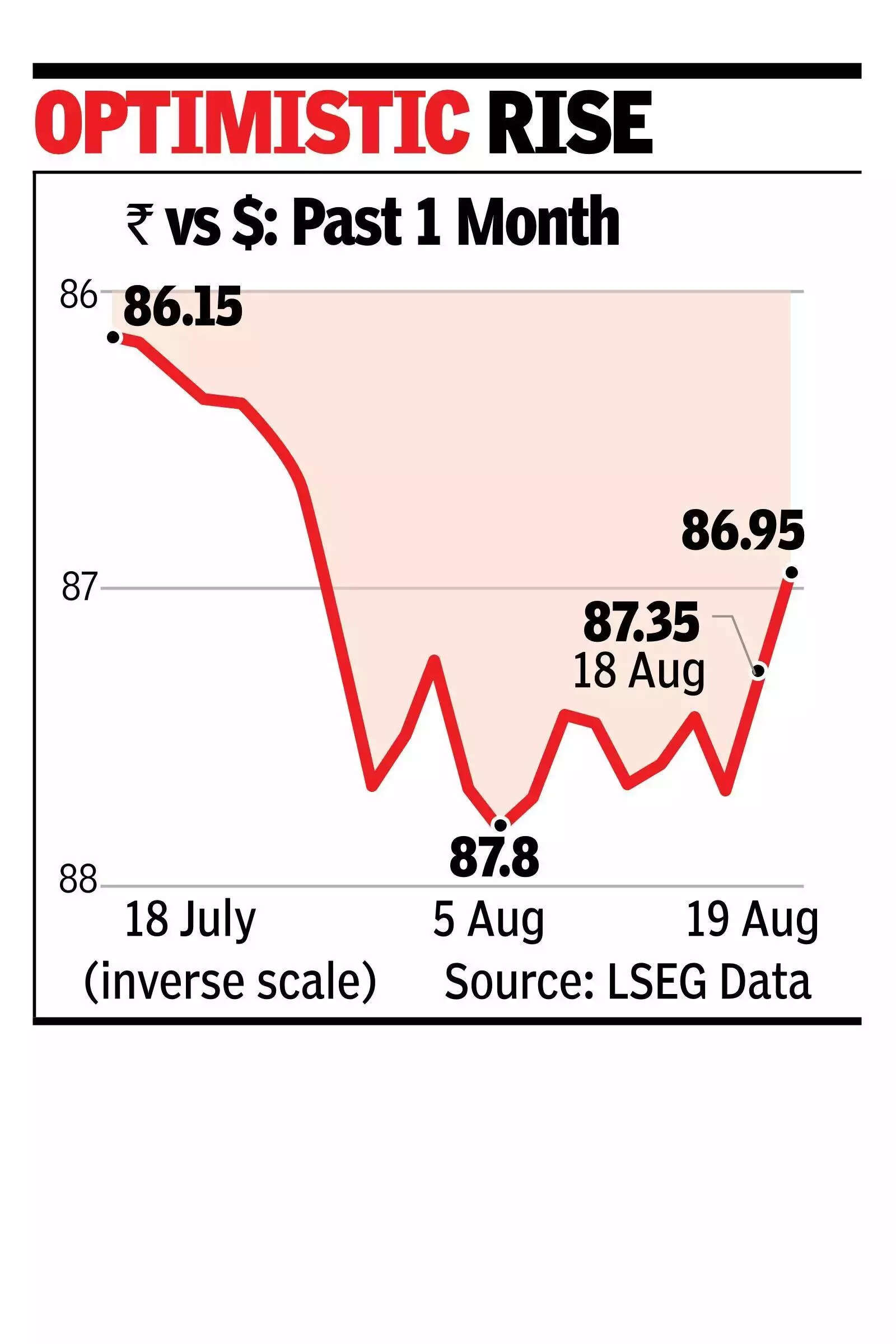

MUMBAI: The rupee recorded its biggest daily gain in a month, regaining the 86 level, with the domestic unit firming up 40 paise to close at 86.95 on Tuesday, up from 87.35 on Monday.The rally came on optimism that the U.S. may ease its stance on additional 25% tariffs after talks between Donald Trump, Vladimir Putin and Volodymyr Zelenskiy, raising hopes of a peace deal that could also reduce the likelihood of fresh sanctions on India’s Russian oil imports.

Optimistic rise

Domestic drivers also supported the currency, including stronger consumption trends and the government’s plan to cut goods and services tax (GST) rates – the biggest such reform in eight years. Economists said the move could lift near-term growth momentum, improve sentiment and help revive foreign portfolio flows that had recently turned negative.The rupee further drew strength from a recent credit rating outlook upgrade for India, which has bolstered confidence in the economy. According to Jateen Trivedi of LKP Securities, the upgrade, along with reduced selling pressure from foreign investors and positive signals from India-Japan ties ahead of the Prime Minister’s visit to Tokyo later this month, has helped improve sentiment, with the rupee expected to trade in a range of 86.60-87.25.Dilip Parmar of HDFC Securities noted that the Indian rupee outperformed Asian currencies due to risk-on sentiment, supported by growth-focused policies, renewed foreign fund inflows and a technical pullback. He added that the spot USD/INR rate is likely to find support at 86.80 and face resistance near 87.20 in the near term.