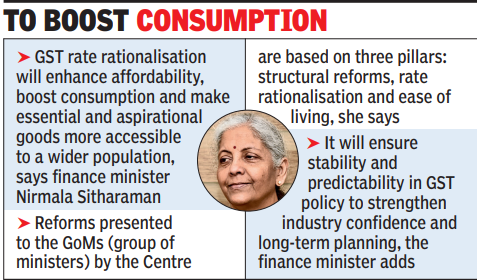

NEW DELHI Finance minister Nirmala Sitharaman said on Wednesday that proposed GST rate rationalisation was aimed at providing greater relief to the common man, farmers, the middle class and MSMEs, while ensuring a simplified, transparent and growth-oriented tax regime.In her address here to the group of ministers (GoM) set up by the GST Council on compensation cess, health and life insurance and rate rationalisation, the FM also said the rate rationalisation would enhance affordability, boost consumption and make essential and aspirational goods more accessible to a wider population. The GoMs will discuss the GST rejig that has been proposed by the Centre over the next two days. Sitharaman also said reforms presented to the GoMs by the Centre are based on three pillars, which include structural reforms, rate rationalisation and ease of living.

She said the proposal by the Centre is with a vision to usher in the next generation of GST reforms in India’s journey towards becoming “Atmanirbhar Bharat”.Sitharaman said the reforms will correct the inverted duty structures to cut input tax credit accumulation and boost domestic value addition, resolve classification issues for simpler compliance and fewer disputes. It will also ensure stability and predictability in GST policy to strengthen industry confidence and long-term planning, the FM insisted during the meeting.She added that upcoming GST reforms will ensure seamless, tech-driven and time-bound registration, introduce pre-filled returns to reduce errors and mismatches and enable faster and automated refunds, all aimed at simplifying compliance, supporting businesses and enhancing overall ease of living and doing business.“The central govt remains committed to building a broad-based consensus with the states in the coming weeks to implement the next generation of GST reforms in the spirit of cooperative federalism,” A finance ministry post on microblogging site X quoted FM.Prime Minister Narendra Modi in his Independence Day speech promised next generation GST reforms, with a two-rate structure and simpler registration and refunds, aimed at providing relief to consumers and businesses. The blueprint of the reforms circulated by the Centre proposed two main slabs of 5% for items of common use and 18% for other goods, and scrapped the 12% and 28% slabs.