BENGALURU: Investment platform Groww is in the process of raising a pre-IPO funding of about $250 million, from a bunch of investors led by Singapore’s sovereign wealth fund GIC, at a valuation of $6.8 billion, said sources familiar with the matter.

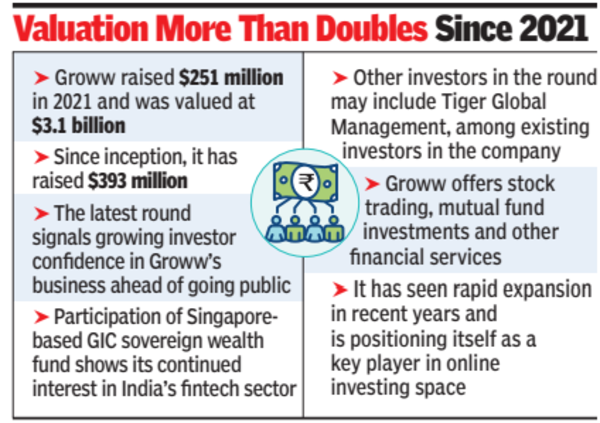

The latest funding round, more than doubling the company’s last recorded valuation in an equity-based fundraise, comes as the Bengaluru-based company prepares for its public listing.

The development signals growing investor confidence in Groww’s business ahead of going public. Spokespersons for Groww and GIC did not respond to TOI’s requests for comment. Other investors in the round may include Tiger Global Management, among existing investors in the company. GIC’s participation underscores its continued interest in India’s fintech sector. The sovereign wealth fund previously backed several high-growth Indian startups across sectors, including Flipkart, Delhivery, Swiggy, Razorpay, and Cred.

Groww, which offers stock trading, mutual fund investments, and other financial services, has seen rapid expansion in recent years and is positioning itself as a key player in India’s online investing space. TOI reported in Jan that Groww is charting a course for an IPO by Dec this year, aiming for a valuation between $6 billion and $8 billion. Groww is set to raise about $600-800 million through the offering, with the issue of new shares and offers for sale by existing shareholders split nearly equally.

The company raised $251 million in 2021 and was valued at $3.1 billion. Since inception, Groww has raised $393 million. Last year, its private-market value reportedly dipped below $2 billion after it merged its US-based holding company with its Indian parent Billionbrains Garage Ventures. Founded in 2016 by former Flipkart executives Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, Groww is backed by investors like Y Combinator, Peak XV Partners (formerly Sequoia Capital India) and Ribbit Capital. For FY24, Groww’s revenue rose 119% to Rs 3,145 crore from Rs 1,435 crore a year ago.