NEW DELHI: Govt is assessing the impact of Pakistan’s airspace closure on air cargo from India that is headed to the Gulf, Europe, and the US. Exporters suggest that the impact is not going to be significant.While most of the cargo moves by sea, around 3-4% of garments are exported on aircraft, either on passenger planes or freighters, with some gems and jewellery also taking that route. Similarly, some electronics are moved by planes, as are some perishables. However, exporters said the quantity is not significant enough to cause any major disruption.

Govt’s decision to ban the transshipment of cargo from Bangladesh will also help soften prices in India. Some pressure is expected towards the end of May, when some shipments will be front-loaded ahead of the July 9 deadline for reciprocal tariffs to kick in. When Trump announced tariffs at the start of April, companies rushed to ship goods to beat the deadline, with Apple shipping five plane-loads of products. Garment buyers and gems and jewellery exporters also saw large quantities of goods being shipped from India by air.

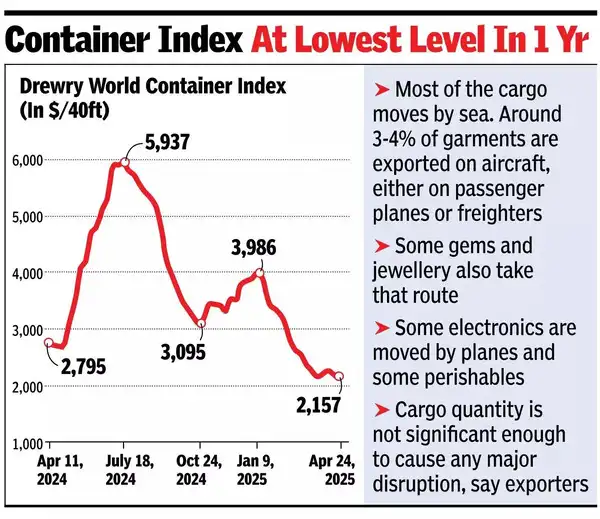

The pressure on freight reduced after US President Donald Trump paused reciprocal tariffs for 90 days, along with a sharp fall in shipments from China. The Drewry WCI composite index fell 2% to $2,157 for 40-foot containers during the week ended April 24, with the rates from China seeing the sharpest fall in the wake of the tariff war. On a year-on-year basis, New York-Rotterdam rates have risen 32% but are down 36% for Rotterdam-Shanghai and 24% for Shanghai-Rotterdam.

Freight rates from Shanghai to New York decreased 3% or $95 to $3,611 per 40ft container during the week ended April 24. Those from Shanghai to Los Angeles and Rotterdam to Shanghai fell 2% to $2,617 and $481 per 40ft container, respectively. However, rates for containers from New York to Rotterdam rose 1% to $825, while costs on Shanghai-Genoa and Los Angeles-Shanghai routes remained stable.

“Drewry expects rates to continue to decline in the coming week due to uncertainty stemming from reciprocal tariffs,” the maritime research and consulting firm said.