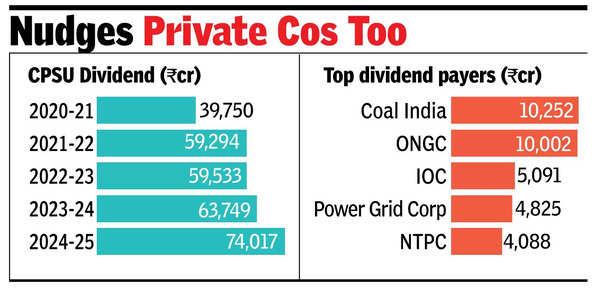

NEW DELHI: After collecting a record Rs 74,000 crore in dividends from central public sector undertakings during the last financial year, govt on Wednesday encouraged private companies to provide fair dividends to their shareholders. It also asserted that it would adjust its disinvestment strategy according to the prevailing market conditions.

“While market capitalisation of public sector undertakings is only 10% of the overall m-cap, they have distributed about 25% of total dividends. We will also encourage private corporations to declare fair dividends for their minority shareholders so that together, we can make our stock market a more inclusive and rewarding space for the common investor,” Dipam secretary Arunish Chawla told reporters.

At the same time, he assured investors that the payout did not come at the cost of capital expenditure and that even in the current financial year, they would meet their investment targets. Citing the record, he urged mutual funds to increase their exposure to central PSUs to improve returns for their investors, especially retail investors. Chawla mentioned that he would be meeting fund houses to explain the strategy and track record.

The civil servant also stated that the Centre balanced market dynamics with the dividend strategy and that his department worked out a model to ensure the maximisation of gains for all shareholders. He said that public issues or offers for sale by PSUs would depend on how the market behaved in the coming days.

He, however, remained non-committal on half-a-dozen strategic sales, including those of Shipping Corporation and BEML. When asked about IDBI Bank’s privatisation, Chawla said the Centre is moving forward with its decision, while simultaneously advancing work on several other fronts. He added that a virtual data room has been set up, and the query resolution process is progressing smoothly. Asset valuers have been appointed for the divestment.