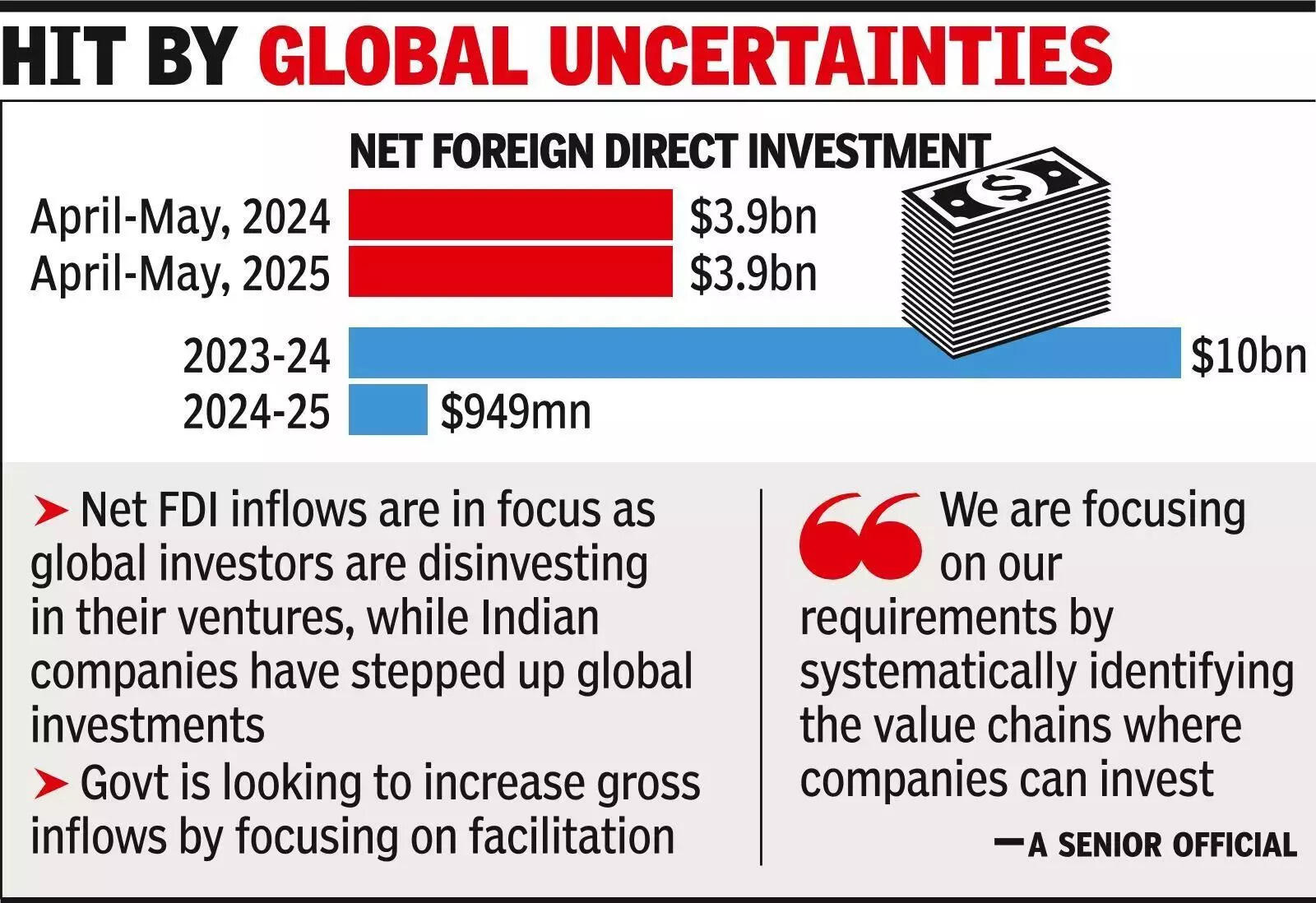

NEW DELHI: Amid signals of companies holding back on investment decisions due to the global uncertainty, govt and Invest India have identified Electronics System Design and Manufacturing, non-leather footwear, chemicals, medical devices, toys and EVs as sectors to court global investors for stepping up foreign direct investment (FDI) inflows.In recent months, net FDI inflows have been in focus as international investors are disinvesting in their existing ventures, largely through IPOs, while Indian companies have also stepped up global investments, resulting in outflows.During April-May, the latest period for which data is available, net FDI was unchanged at $3.9 billion, although gross inflows rose from $15.1 billion to $15.9 billion. In 2024-25, net inflows were estimated at $949 million as against $10 billion in the previous year.

Govt is looking to increase gross inflows by focusing on facilitation. “We are focusing on our requirements by systematically identifying the value chains where companies can invest,” a senior official said. While the new electronics components scheme has seen a lot of traction, as India seeks to build a resilient supply chain and reduce dependence on China, govt is also banking on a shift away from China as companies diversify their production ecosystem.In sectors such mobile phones, the production linked incentive scheme has seen the likes of Foxconn invest heavily in India along with their vendor base. Besides, officials said, in segments such as air conditioners too, there was increased focus on manufacturing compressors, motors and copper tubes in India, driven by incentives. The PLI scheme had also helped pharma and medical devices production, the official said. “We are discussing how we can take this forward,” the source added.While companies such as Vinfast have entered India to tap into the growing demand for electric vehicles, discussions around lowering import duty through the trade agreements has resulted in some other companies holding back on plans to invest in manufacturing facilities in India. This is despite a special scheme launched by govt that allows imports at subsidised rates for three years, based on a commitment to make in India subsequently.Chinese companies such as BYD were also keen to set up a plant in India but govt has imposed checks on these investments.