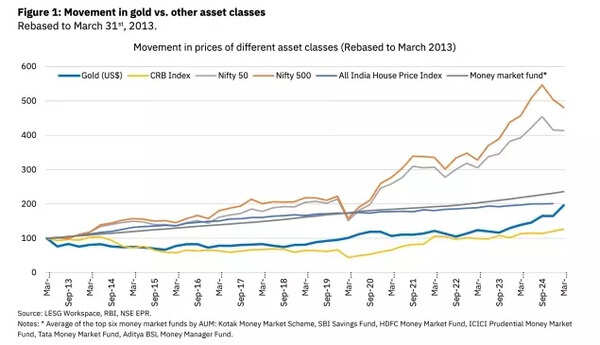

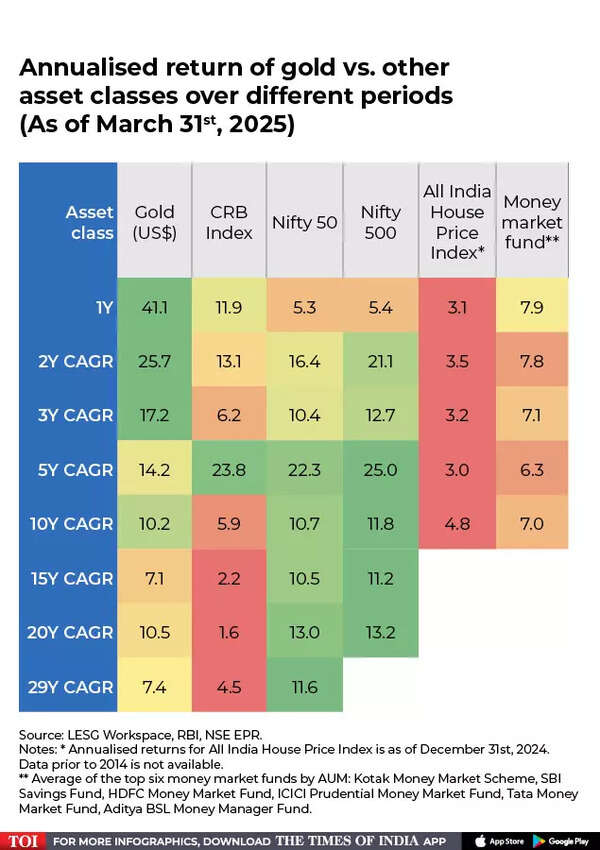

Gold, traditionally a safe have investment, was the best-performing asset class in financial year 2024-25, according to the latest edition of NSE’s ‘Market Pulse’ report. Gold recorded a 41% gain in USD terms and 33% in rupee terms, reaching unprecedented levels exceeding US$3,125/oz (Rs 88,946 per 10 grams).This is mainly because of its status as a secure investment during times of global instability. Gold price increase has been supported by central bank acquisitions in recent years. Nevertheless,Indian equities have shown better performance over extended periods, However, it’s important to note that Indian equities have yielded superior returns, on a longer term horizon. The Nifty 50 has achieved a 13% yearly price increase and a 14.4% total return (inclusive of dividends) across 20 years, surpassing gold’s performance during comparable timeframes, according to NSE’s April edition of ‘Market Pulse’ report.Gold demand reached its highest level in 15 years, driven by substantial investment flows and persistent central bank acquisitions—more than 1,000 tonnes for the third consecutive year—as part of a broader strategy to diversify reserves.

Gold vs other asset classes

Annualised return of gold vs other asset classes

The Reserve Bank of India emerged as the third-largest official purchaser over both three and five-year periods, with gold now constituting more than 11% of its foreign exchange reserves. Although jewellery consumption decreased due to elevated prices, investment interest strengthened, especially across Asia, with Chinese and Indian markets leading in bar and coin acquisitions.Gold began 2025 displaying robust upward movement, continuing its upward trajectory from the previous year, bolstered by unprecedented central bank acquisitions and increased institutional participation through ETFs. The World Gold Council suggests that whilst prices could remain within established boundaries under normal circumstances, unbalanced risks indicate possibilities for higher values. As the global financial landscape adapts to an increasingly divided international system, central banks are anticipated to maintain their significant gold purchases throughout 2025, serving as a crucial component of overall demand.As geopolitical tensions and economic uncertainties continue, fundamental factors supporting gold demand remain strong. Central banks are anticipated to maintain their position as principal buyers, whilst global reserve management adapts to an increasingly divided economic environment.