HYDERABAD: Escalation in US-China tariff war sent gold prices soaring past the $3,300/ounce mark for the first time in international spot markets on Wednesday, catapulting the yellow metal to a new high of $3,318, pushing it to within touching distance of the Rs 1 lakh/10 gm (24K) mark in the Indian market.

The price surge sent the precious metal racing to all-time highs in the domestic markets. Gold shot past the Rs 98,000-mark in Delhi where it was quoting at Rs 98,100 by evening. On MCX too, gold reached an all-time high of Rs 95,435 for June futures.

“Gold rose to a new record high, surpassing the previous all-time peak set on Monday. Traders were whip-lashed again by a slew of tariff headlines; in the latest, US President Donald Trump ordered a probe into critical minerals, sparking a move toward safe haven assets,” said Saumil Gandhi of HDFC Securities.

The skyrocketing prices have, however, significantly dampened consumer appetite for the gold, which is selling at a discount to the import prices in local markets, pointed out Avinash Gupta, vice-chairman, All India Gem & Jewellery Domestic Council.

“Since the dip in prices to $2,982 on April 8, gold has shot up by $336/oz, an 11% increase in just the past eight days. This is the fastest rise in gold prices in a span of eight days, which confirms the parabolic movement in gold. Because of this steep price rise, gold is selling at a discounted price of 1-2% of the actual landing cost in India,” Gupta said.

Surendra Mehta, national secretary, India Bullion and Jewellers’ Association, said the phenomenon has led to an unprecedented situation where there are more consumers walking in to sell gold to either book profits or to exchange old gold for new than those trooping in just to buy the precious metal.

Gupta said: “Whenever prices go up so drastically, consumer sentiments do take a beating, impacting retail sales. But in this case I suspect those who have run up losses on the stock markets may be booking profits in gold to offset their losses.”

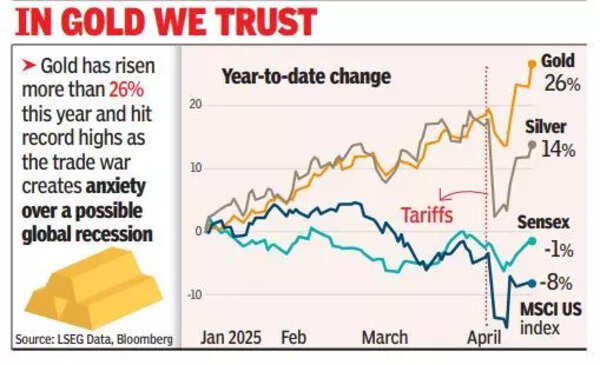

However, at a time when the ongoing US-China trade wars have set gold prices on fire, silver has failed to match pace. On Wednesday, international spot prices for the white metal were at $32.8/oz and crossed the Rs 1 lakh/kg mark in the Delhi spot markets.

“The demand for silver is primarily driven by industrial demand but the tariff wars are threatening to spark off a recession. If these trade wars settle down, silver is the only metal that will rise at a quick pace,” Gupta said.

The rally in gold may well run further with experts saying they expect the bullish momentum to continue.