Bramesh

Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 1606 contracts with a total value of 124 crores. This activity led to a decrease of 96 contracts in the Net Open Interest.

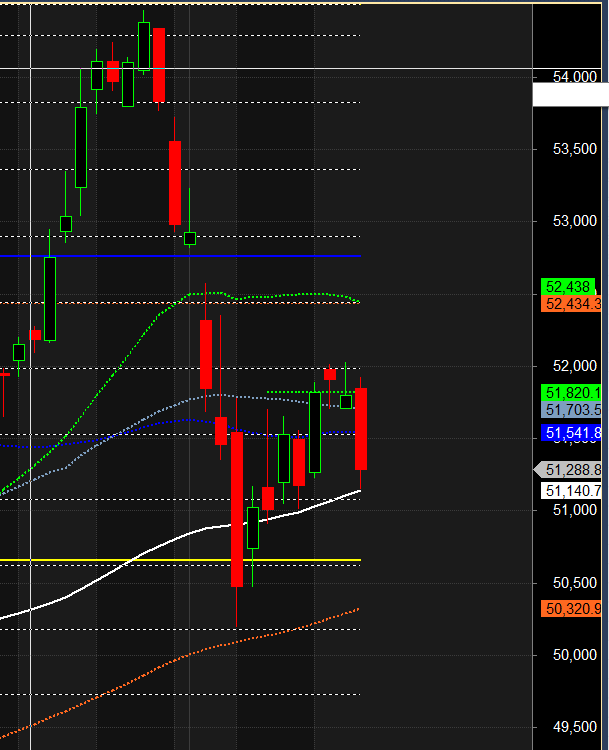

Bank Nifty continue to trade in small range as we have a confluence of time cycles—both Gann and astro— as discussed in the video below. The price has been stuck in the 52000–51700 range for the last 2 trading sessions. With the convergence of price and time, this range is likely to break within the next two days. A break below 51700 could lead to a fall towards 51424/51108, while holding above this level could trigger a rally towards 52400/52666 once the price clears 51900.

Intraday traders should focus on the first 15 minutes’ high and low to capture the trend for the day.

FIIs have been continuously selling net equities in India. So far in October, FIIs have sold a massive ₹74,730 crore worth of shares in the market. This marks the highest-ever monthly net selling by FIIs, surpassing the previous record of ₹68,308 crore in March 2020, when COVID-19 began spreading globally.

Meanwhile, DIIs have been buying equities during the week. The heavy equity selling by FIIs yesterday could indicate that we are nearing the bottom. (I follow the premise that the equity cycle lags behind the F&O cycle, and high activity in equities generally signals the culmination of that particular cycle.)

We saw the impact of the Gann and astro cycles, leading to a significant drop in Bank Nifty. With Venus Ingress tomorrow, the first 15 minutes’ high and low will again be crucial in determining the day’s trend and focus on Private Banks. 50935 is the gann angle support zone. Price is back to 100 SMA support zone. Unable to hold 51000 can lead to fall towards 50320 towards 200 SMA.

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 51347 for a move towards 51575/51803/52031 .Bears will get active below 51119 for a move towards 50891/50663/50434

Traders may watch out for potential intraday reversals at 09:15,10:46,11:53,12:36,02:37 How to Find and Trade Intraday Reversal Times

Bank Nifty September Futures Open Interest Volume stood at 29.7 lakh, with addition of 0.82 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 02:09 and Bank Nifty Rollover Cost is @54325 closed below it.

Bank Nifty Gann Monthly Trade level :51820 closed below it.

Bank Nifty closed below its 100 SMA @51378 Trend is Sell on Rise.

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263-54801. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 51500 strike, followed by the 52000 strike. On the put side, the 51000 strike has the highest OI, followed by the 50500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 50500 -51500 range.

The Bank Nifty options chain shows that the maximum pain point is at 51300 and the put-call ratio (PCR) is at 0.92. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

The first losses leave the deepest traces. Over time, however, you get used to it and the subsequent losses are no longer perceived with the same intensity, no matter how great they may be. The trader feels indifferent: “Oh, it doesn’t matter whether I lose the money or not!”

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 52593 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 51583 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 51375 Tgt 51500, 51666 and 51800 ( BANK Nifty Spot Levels)

Sell Below 51144 Tgt 51050, 50888 and 50729 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

Related