MUMBAI: In one of the largest block deals in recent times, InterGlobe Aviation co-founder Rakesh Gangwal and his family have sold shares worth Rs 11,564 crore on Tuesday. The promoters sold 2.21 crore shares of InterGlobe, Indigo’s parent, comprising a 5.72% stake in India’s largest airline.The total offering was increased to 2.21 crore shares, from the initially planned 1.32 crore shares.Gangwal sold 22.10 lakh shares, while the Chinkerpoo Family Trust, associated with his family, offloaded 1.99 crore shares in the block deal on NSE. The exchange disclosure did not identify the buyers.

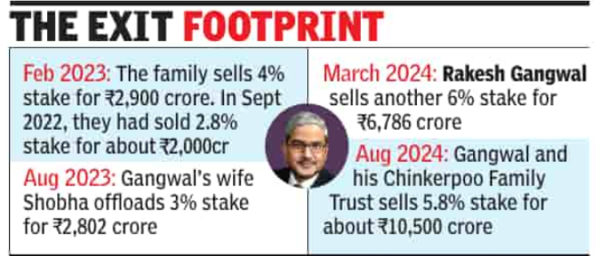

According to the term sheet issued on Monday, the shares were offered at a floor price of Rs 5,175 apiece – a 4.5% discount to IndiGo’s closing price of Rs 5,420 on the NSE as of May 26.As of March 31, 2025, the Gangwal family held a 13.53% stake in the airline. Following the latest transaction, Gangwal and his family’s stake has been reduced to 7.81%. The stake sale is part of a phased exit strategy by Gangwal and his family from the company, which he co-founded with Rahul Bhatia in 2006. Three years ago, the family’s holding stood at nearly 37%.Gangwal stepped down from IndiGo’s board in February 2022 and publicly announced plans to gradually reduce his stake. Since then, the family has been steadily paring its shareholding. In August 2024, they sold a 5.25% stake for Rs 9,549 crore, following an earlier sale of a 5.8% stake in 2024 that fetched Rs 6,786 crore. In August 2023, Shobha Gangwal fully exited by selling her 4% stake for Rs 2,944 crore.The stake sale by Gangwal and family on Monday is one of the largest secondary market deals in recent times. On May 16, Singapore Telecommunications (Singtel) sold 7.1 crore shares in Bharti Airtel for Rs 13,221 crore. The most significant block trade ever executed in India’s secondary market was in March 2023, when British American Tobacco Plc (BAT) offloaded a 3.5% stake in ITC for Rs 17,485 crore.