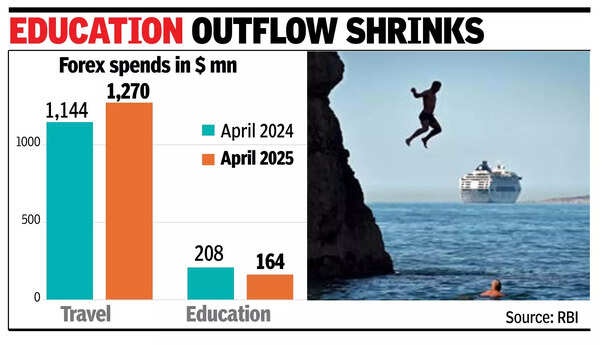

MUMBAI: Overseas spending by Indians rose 8.5% to nearly $2.5 billion in April from close to $2.3 billion a year ago, with travel continuing to dominate and financial investments seeing a sharp rise. RBI’s liberalised remittance scheme permits Indian individuals to spend or transfer up to $250,000 abroad every year.Travel maintained its lead as the top spending category, with its share increasing to 51.2% from 50.1%. The increase suggests that international travel as a spend category, which peaked with 63% share in Aug 2024 before dipping, is making a comeback. Spending on equity and debt investments nearly doubled, with this category’s share of total spend rising to 8.2% from 4.3%.

Property purchases also gained ground, with their share rising to 1.8% from 1%, reflecting renewed interest in offshore real estate assets. Deposits showed a marginal increase to 3.8% from 3.2%, suggesting a moderate uptick in savings held abroad.In contrast, several other categories saw a relative decline in share. Gift-giving fell to 11.7% from 13.6%, while maintenance of close relatives dropped to 16% from 17.2%. Education-related remittances experienced a steep fall, with the share of overseas study fees in total forex spend declining to 6.6% from 9.1% – likely reflecting immigration restrictions in the US. The share of spending on offshore medical treatment halved to 0.2%. A stronger rupee reduces the incentive for individuals and businesses to remit funds abroad, as they can get more value for their money by waiting for potentially more favourable rates.