NEW DELHI: The commerce department on Wednesday unveiled the elements of the Export Promotion Mission focused on providing low-cost and collateral-free loans, backing new instruments, supporting opportunities in new markets and boosting export credit to e-commerce, amid concerns that the overall allocation of Rs 2,250 crore was spread too thinly.

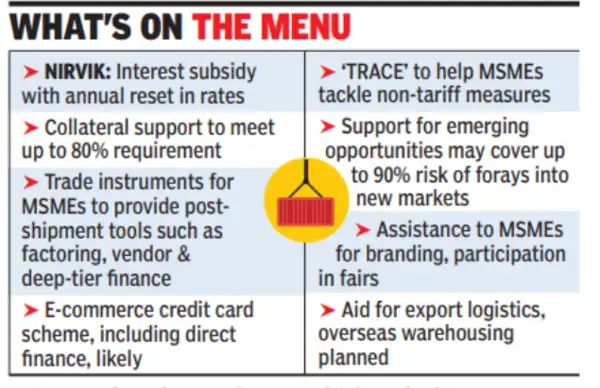

Top of the agenda is Niryat Rin Vikas or NIRVIK, an interest equalisation scheme targeted at MSMEs and new exporters. The plan is to reset interest rates annually by benchmarking them to rates in other countries that Indian exports are competing with. The decision flows from the realisation within govt that interest rates in India are twice, if not thrice, the level in countries such as China, South Korea, Singapore, Malaysia, and Thailand.

The scheme will come with a specified cap with a negative list of sectors linked to parameters, such as low value addition, raw material or primary products, and items where there is a high probability of misuse, sources told TOI. Exporters will get the benefit upfront with banks getting reimbursed.

Govt is also seeking to end the hardship faced by exporters – especially MSMEs and e-commerce – due to banks demanding collaterals. The plan is to provide over 80% of the collateral requirement based on track record through an online evaluation and monitoring mechanism. Exporters will be given a unique ID with fund disbursals on a monthly or quarterly basis under the scheme where a credit guarantee fund will be roped in.

The commerce department has also lined up plans to provide easier access to working capital through trade finance instruments, with post-shipment tools, such as factoring, reverse factoring, and vendor financing for small exporters. The overall benefit will come with a ceiling, sources indicated.

Similarly, to support emerging opportunities, the govt intends to share up to 90% of the risk of MSMEs, which are looking to venture into “new, high-risk markets”, with at least 1,000 exporters to be backed in the first year. The Centre intends to use the Trade Assistance Fund to invest in liquid assets allowed under EXIM Bank’s investment policy, sources said.

A Focused Market Access Initiative is also planned to help exporters tap new opportunities. Govt will support their participation in fairs and meet up to 90% of the cost. This will be in addition to a boost for branding.