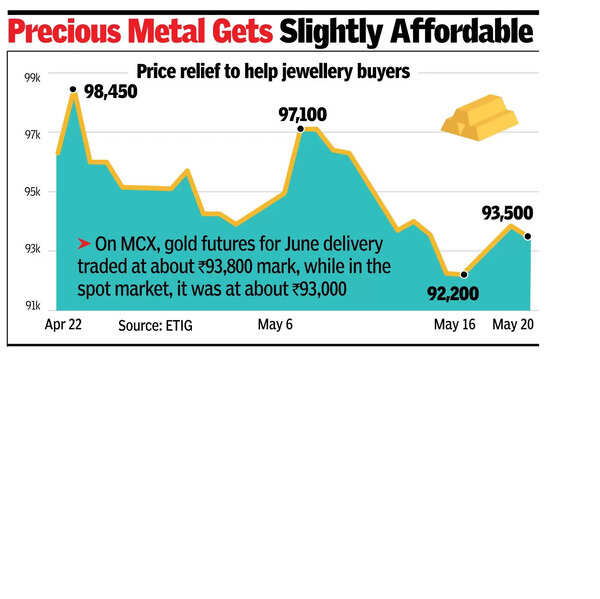

MUMBAI: The ongoing risk-on rally in global markets, after geopolitical and tariff-related uncertainties subsided in the last few days, led to a correction in the price of gold, which is down about 6-7% from its all-time peak of $3,500/ounce level.In the domestic market too, gold is currently trading at around Rs 93,000/10gm level. It is down from Rs 1 lakh level about a month ago and at about Rs 97,000 level on May 9, the day before the Indo-Pak ceasefire between the two nuclear-powered neighbours.According to Renisha Chainani, head of research at Augmont, a gold trading platform, there are at least two fundamental reasons for the sluggish demand for gold in the international markets. “Gold is still struggling, and prices could drop this week as the market takes a wait-and-see stance as the initial reaction to the US credit rating fades and there is some hope that Ukraine and Russia could reach a truce,” Chainani said.Following a two-hour phone call with US President Donald Trump on Monday, Russian President Vladimir Putin said that attempts to put an end to the war are on track and he’s committed to collaborate with Ukraine on a memorandum pertaining to a peace agreement.

Since gold prices, among other reasons, also thrive on economic and geopolitical uncertainties, a ceasefire between Russia and Ukraine is sure to see some slide in the price of the yellow metal, industry analysts said.On Tuesday, on MCX, gold futures for June delivery were trading at about Rs 93,800 mark, while in the spot market, it was trading at about Rs 93,000. Early on Tuesday, in the international market, gold was trading below the $3,215 mark as investors’ focus was shifting to potentially easing US-China trade tensions, a report by Kotak Securities said.Early last month, after Trump announced a series of tariff-related policies for the world’s largest market, it elevated global economic and market uncertainties. As a result, by the third week of April, gold prices scaled above the psychologically important Rs 1 lakh mark.