EchoStar stock roared more than 80% higher on Tuesday after AT&T said it agreed to purchase certain wireless spectrum licenses from the telecom company for about $23 billion in an all-cash deal.

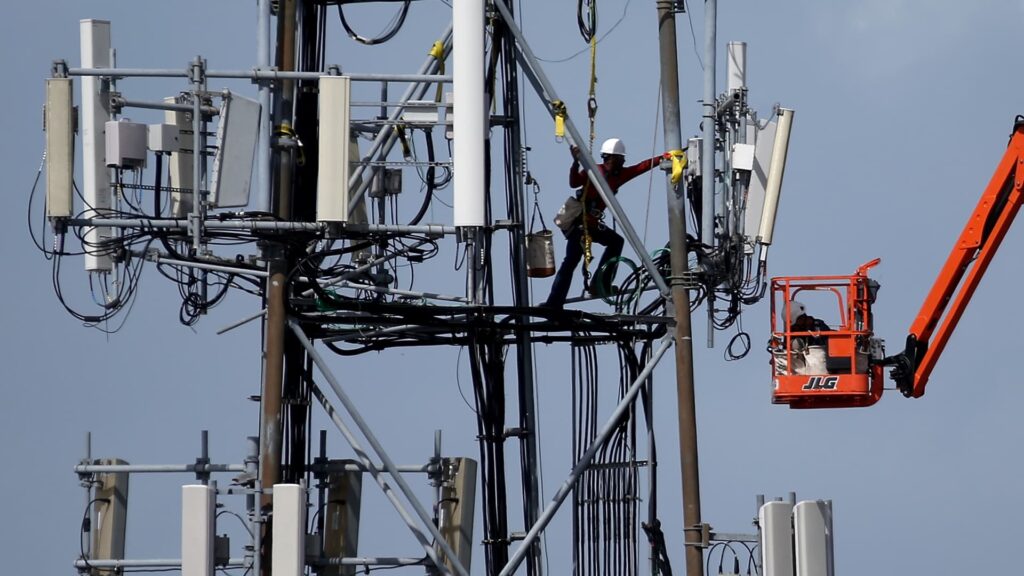

The sale will add about 50 megahertz of mid-band and low-band spectrum to AT&T’s network, with the licenses covering more than 400 markets across the U.S., AT&T said. The deal is expected to close in mid-2026, pending regulatory approval.

EchoStar said in a regulatory filing that the transaction is part of the company’s “ongoing efforts to resolve the Federal Communications Commission’s inquiries.”

FCC Chairman Brendan Carr wrote in a May letter addressed to EchoStar Chairman and cofounder Charlie Ergen that the agency’s staff would investigate the company’s compliance with federal requirements to build a 5G network.

The letter followed complaints from Elon Musk’s SpaceX that EchoStar had left “valuable mid-band spectrum chronically underused,” and the FCC should take steps to let “new satellite entrants” put it to use.

SpaceX owns Starlink, which provides internet service through a constellation of low Earth orbit satellites.

As part of Tuesday’s announcement, AT&T and EchoStar also agreed to expand their network services agreement, enabling EchoStar to operate as a hybrid mobile network operator providing wireless service under the Boost Mobile brand.

“EchoStar and Boost Mobile have met all of the FCC’s network buildout milestones,” Ergen said in a statement. “However, this spectrum sale to AT&T and hybrid MNO agreement are critical steps toward resolving the FCC’s spectrum utilization concerns.”

AT&T CEO John Stankey told CNBC that the deal is “a win all the way around.”

“It’s a fantastic opportunity to see more services put together the way customers want to buy them together,” Stankey said in an interview on “Squawk Box.” “And as a result of that, I think ultimately regulators are going to look at this and say, it’s very, very attractive.”

AT&T shares rose less than a percent.