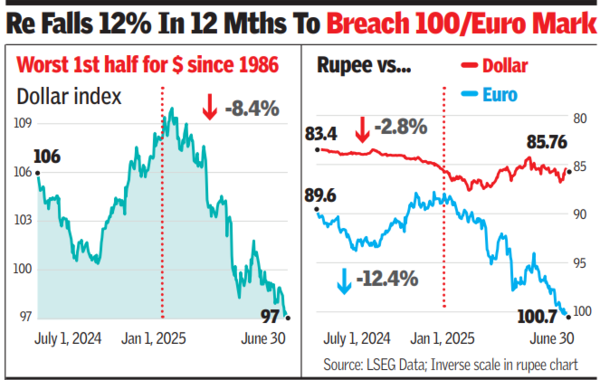

Mumbai: The dollar ended June with its worst first-half performance in four decades. However, the dollar’s slide in the international markets has been masking the rupee’s weakness, which is seen in its movement against the euro. The rupee breached the Rs 100 level against the European currency in late June – marking a 12.4% depreciation over the past 12 months. The slide has been more severe than the modest 2.8% drop against the dollar, which has obscured the extent of the rupee’s broader decline in global currency markets. The euro has gained 9.4% against the dollar during the same period. This divergence has widened the gap between the euro and the rupee, pushing the euro/rupee rate to record highs.

The underlying cause lies in diverging monetary policy expectations. While the US Federal Reserve has signalled a pause in its rate hikes, the European Central Bank has remained hawkish, sustaining the euro’s strength. The dollar index fell by about 10.6% since the start of the year, dropping toward 97 points for the first time since Feb 2022, marking the worst first-half for the greenback in nearly 40 yearsThe rupee slipped on Monday to end the month and quarter slightly lower, trailing most Asian peers amid muted portfolio inflows and weighed down by the country’s external investment deficit.