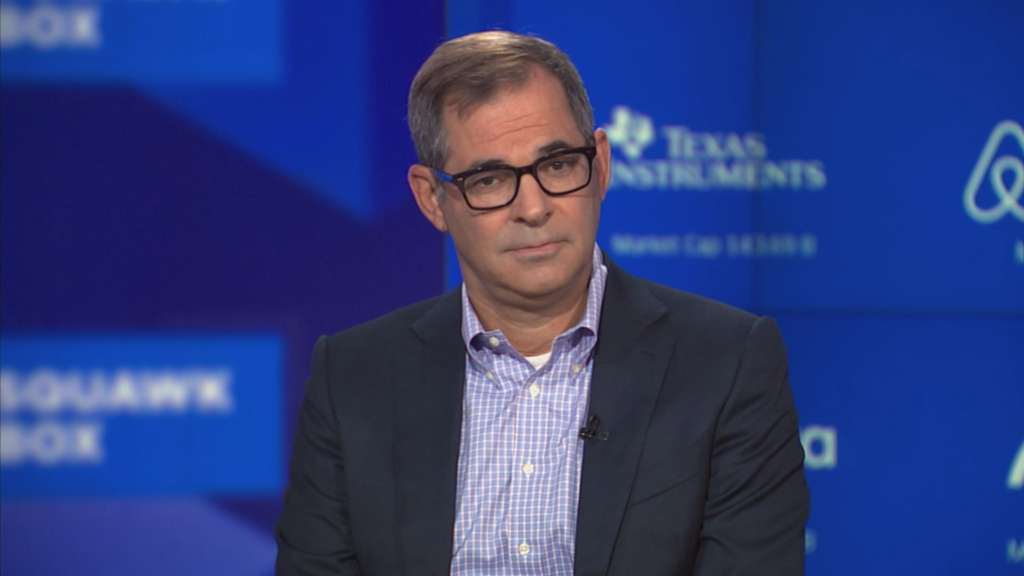

Michael Intrator, CoreWeave CEO appears on CNBC on July 17, 2024.

CNBC

CoreWeave CEO Michael Intrator told CNBC Tuesday that the firm’s proposed acquisition of Core Scientific would be a “nice to have” rather than a necessity as shareholders prepare to potentially block the deal.

In July, AI cloud provider Coreweave proposed an all-stock deal valued at around $9 billion to buy the Bitcoin miner and data center firm, Core Scientific. Immediately after the news, Core Scientific’s stock price fell, plummeting nearly 18%.

The deal has received criticism with key proxy advisor Institutional Shareholder Services (ISS) recommending on Monday that shareholders vote against the acquisition. Core Scientific’s share price has conitnued to rise after the deal was announced which suggests some investors think that the company is valued higher than what CoreWeave has offered, ISS said.

Intrator said that he was “disappointed” by the ISS report and continues to believe that the deal is “in the long-term interest of Core Scientific shareholders.” However, CoreWeave will not raise the price of the offer.

“We think that the bid that we put out there for [Core Scientific] is a fair representation of the relative value of the two companies as an all stock deal,” Intrator told CNBC. “We are going to just kind of proceed as we have, in the event that the transaction does not go through. It is a nice to have, not a need to have for us.”

“Everything has a value, and the number we put out is the value we’re willing to pay for them under all circumstances,” Intrator added.

Earlier this month Two Seas Capital, a major Core Scientific shareholder publicly opposed the acquisition saying that the price CoreWeave is offering is too low. Shareholders will vote on the deal on October 30.

“We see no reason why Core Scientific shareholders should accept such an underwhelming deal. Based on recent trading data, we see little evidence that they will,” Two Seas Capital said in an October 17 letter to shareholders.

CoreWeave has aggressive pursued acqusitions this year to buy AI-related firms like OpenPipe, Weights & Biases, and Monolith as it looks to expand its product offering.

The company, which has built data centers and offers Nvidia-powered computing power to hyperscalers like Microsoft, has been riding the wave of artificial intelligence investments.

“We’ve been in acquisitive mode as we continue to build and extend the functionality of our company,” Intrator said.