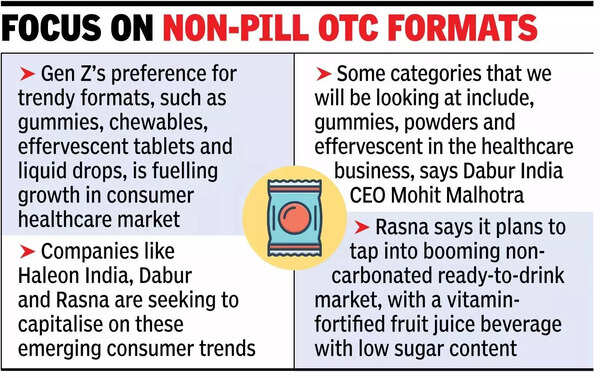

NEW DELHI: Gen Z’s preference for trendy, convenient, and non-pill OTC formats such as gummies, chewables and effervescent powders, combined with rising health awareness, is fuelling significant growth in India’s consumer healthcare market.The trend is driving strong investments in innovation as companies including Haleon India, Dabur and Rasna seek to capitalise on emerging consumer trends and diverse cohorts. Despite sluggish demand, companies continue to invest steadily in innovation – both organically and through acquisitions – being aware that returns typically require a longer-term horizon.For some, like Haleon India (formerly GlaxoSmithKline Consumer Healthcare), this strategy is already paying off. The company achieved a high single-digit revenue growth in the quarter ended March 2025, outperforming other Asia-Pacific markets, including China. The UK-based giant, with revenues exceeding over $14.3 billion, plans to democratise healthcare in India – where high costs remain a barrier – by focusing on small, affordable packs of its leading brands tailored for value-conscious consumers, according to Navneet Saluja, general manager, Indian sub-continent, Haleon.

Innovative formats like gummies, effervescent tablets, chewables, and liquid drops are gaining traction, driven by direct-to-consumer brands in India’s over Rs 40,000 crore consumer healthcare market. This mirrors global trends, where convenience, palatability, and visual appeal are key factors shaping consumer preferences.Homegrown FMCG company Dabur has undertaken a comprehensive refresh of its ‘Vision’ strategy to achieve a sustainable double-digit CAGR by FY28 in both topline and bottomline. Says Dabur India CEO Mohit Malhotra: “Premiumisation and contemporisation across categories is a key pillar of this strategy. Some categories that we will be looking at include, gummies, powders and effervescent in the healthcare business. In addition, we have been increasing the relevance of our time-tested and efficacious products by introducing new age formats”. And, to cater to health-conscious Gen Z, Rasna, a mass-market beverage brand, recently acquired ready-to-drink (RTD) brand Jumpin from Hershey’s India. Piruz Khambatta, group chairman of Rasna says the company plans to tap into India’s booming non-carbonated RTD market, with a vitamin-fortified fruit juice beverage that has low sugar content.These moves reflect a broader trend: The demand for convenient, on-the-go product options is rapidly expanding, unlocking strong growth potential in India.