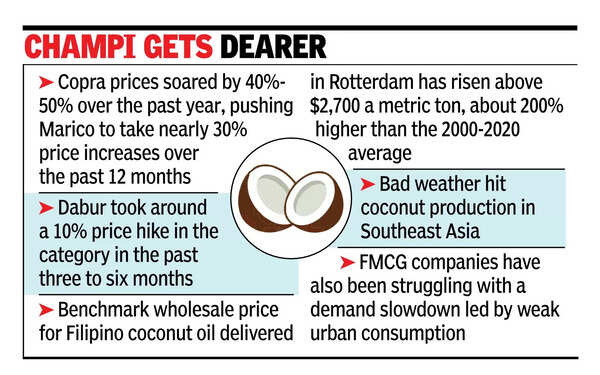

MUMBAI: The humble coconut oil-a must-have product in almost every Indian household-may be the reason your grocery bills pinched you a bit more. Companies like Marico and Dabur collectively took close to 40% price hikes in coconut oil over the past 12 months due to high inflation in the category.Prices of commodities have more or less ‘peaked’, and any major price increases are unlikely to be passed on to consumers unless there’s a ‘black swan event’, said Saugata Gupta, MD & CEO at Marico, who is betting on better volume growth for the FMCG sector this financial year. For Marico, which makes Parachute coconut oil, copra (from which coconut oil is derived) makes up a large share of its commodity basket. Copra prices soared by 40%-50% over the past year, pushing Marico to take nearly 30% price increases over the past 12 months, Gupta told TOI.Marico leads the coconut oil market with more than a 50% share, according to market estimates. Firms with a bigger play, like Marico, use copra to derive coconut oil, while some buy the oil directly from the market.

Dabur took around a 10% price hike in the category in the past three to six months, stockist sources said. “We mitigated the impact of inflation through a mix of value engineering, cost-saving initiatives, and judicious price increases, keeping the competitive intensity in mind,” said Ankush Jain, CFO at Dabur India.Coconut oil is on the boil globally, with prices hitting a record high. Earlier this month, the benchmark wholesale price for Filipino coconut oil delivered in Rotterdam rose above $2,700 a metric ton, about 200% higher than the 2000-2020 average, Bloomberg reported. Bad weather hit coconut production in Southeast Asia.The local consumer goods industry is contending with high input cost inflation in a few other commodities, such as cocoa and edible oils, as well. Crude, though, has been soft, giving some relief to firms. FMCG companies have also been struggling with a demand slowdown led by weak urban consumption, which firms hope will see revival going ahead, helped by easing food inflation. The biggest player, Hindustan Unilever (HUL), expects the first half of FY26 to be better than the second half of FY25. Marico’s Gupta said that the industry will see better volume growth this FY. “Urban demand didn’t deteriorate further. It’s subdued but not stressful,” Gupta said, adding that companies will have to continue premiumising to sustain growth even in a sluggish environment. “The extra disposable income that consumers will get through the tax breaks will be spent on upgrading and discretionary, not necessarily only staples,” said Gupta.