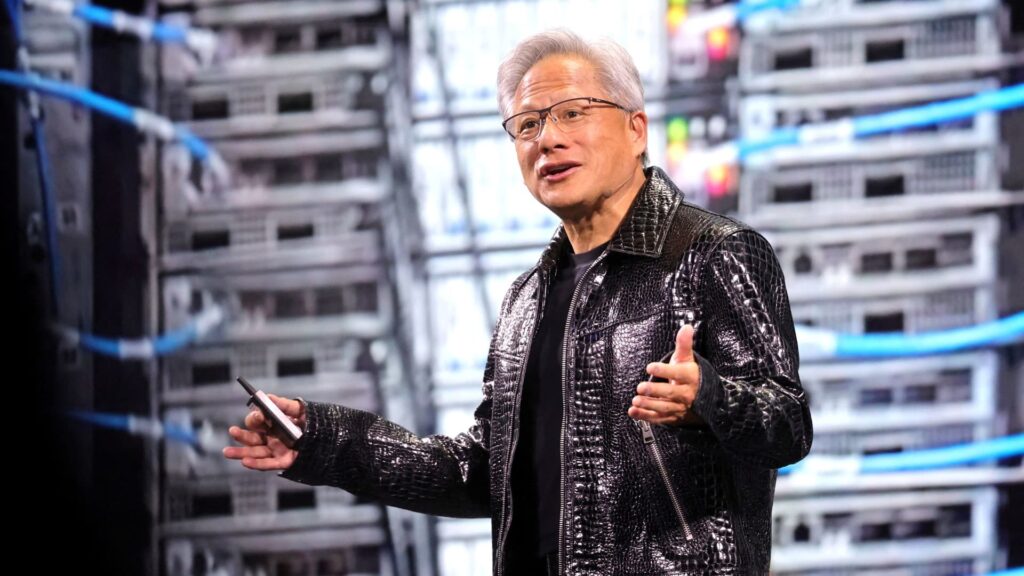

Nvidia CEO Jensen Huang gives a keynote address at CES 2025, an annual consumer electronics trade show, in Las Vegas, Nevada, U.S. Jan. 6, 2025.

Steve Marcus | Reuters

More than two years into the generative artificial intelligence boom, Wall Street is setting an increasingly high bar for chipmakers.

When it comes to earnings reports — most recently from Marvell Technology — good isn’t good enough. That’s because investors previously poured into the companies making the infrastructure and devices at the heart of the AI economy, bidding the stocks up to historically high levels.

They’re demanding results.

Marvell shares plummeted 20% on Thursday, their steepest slump since 2001, after guidance fell short of some elevated estimates. The company’s revenue forecast as well as its results for the latest quarter were all ahead of the average analyst estimate, according to LSEG, but Wall Street wanted more after the stock soared 83% in 2024.

“While Marvell reported a small beat and raise, the guide was definitively below buyside expectations,” analysts at Cantor wrote in a report following the results.

Nvidia suffered a similar fate in late February, with its stock dropping 8.5% the day after the leader in AI processors reported earnings and revenue that sailed past estimates. Shares of Advanced Micro Devices fell more than 6% earlier in February after beating expectations. The one troubling number for AMD was a miss in its data center business.

Optical supplier Credo Technology plummeted 14% after earnings on Wednesday and another 10% during Thursday’s session despite triple-digit revenue growth and upbeat guidance.

The VanEck Semiconductor ETF is down nearly 6% this week following last week’s 7% decline. The ETF, whose leading components are Nvidia, Taiwan Semiconductor Manufacturing Co. and Broadcom, soared 72% in 2023 and nearly 39% last year.

The challenge on Wall Street for chipmakers underscores the pressure they’re under as the AI buildout stretches into its fourth calendar year. Tariffs from the Trump administration and chip export controls have added to investor concerns.

However, not all companies in the space are getting the same treatment. Broadcom shares lost 6% during Thursday’s session in the lead-up to quarterly earnings, but the stock popped 12% after hours on better-than-expected results, including strong infrastructure and semiconductor revenue.

Don’t miss these insights from CNBC PRO