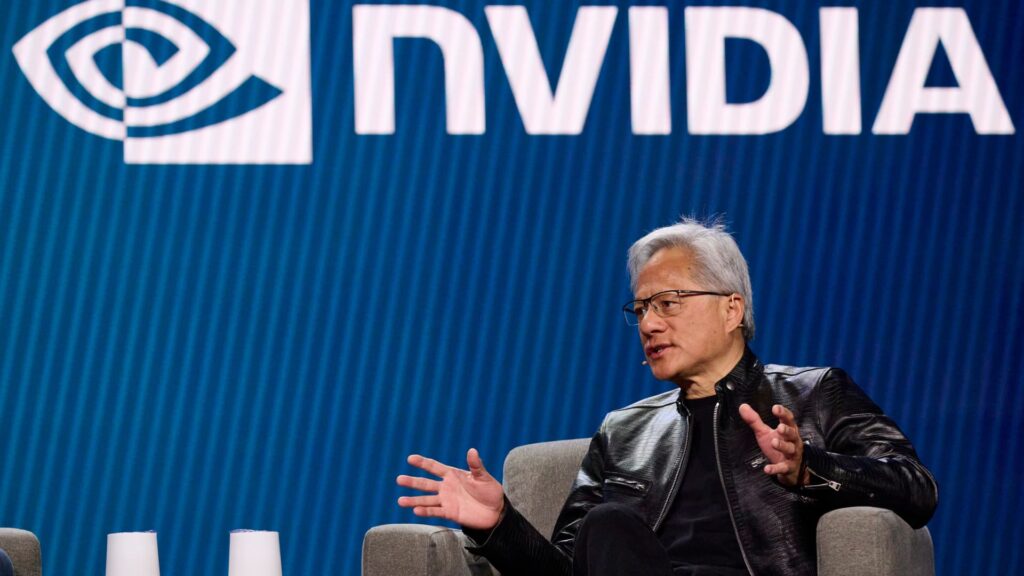

Jensen Huang, chief executive officer of Nvidia Corp., speaks during the 2026 CES event in Las Vegas, Nevada, US, on Tuesday, Jan. 6, 2026. Siemens and Nvidia announced an expansion of their strategic partnership to develop industrial and physical AI solutions to bring AI-driven innovation to industrial workflow. Photographer: Bridget Bennett/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

Chip stocks jumped on Wednesday thanks to strong earnings from heavyweights ASML and SK Hynix and a report that China has approved the sale of Nvidia’s H200 chips.

The VanEck Semiconductor ETF was up more than 3% in premarket trade.

In Europe, ASML was 5% higher in morning trade with other semiconductor firms, including Infineon and STMicro, also in the green.

Dutch chipmaker ASML on Wednesday reported bumper fourth-quarter earnings with orders above analyst expectations, while its 2026 sales forecast was also ahead of estimates.

South Korea’s SK Hynix shares closed more than 5% higher after it reported record full-year profit for 2025.

Meanwhile, Reuters reported on Wednesday that China has approved domestic tech giants ByteDance, Alibaba and Tencent to buy Nvidia’s H200 system, a critical development in the long-running saga of Nvidia’s position in China, a huge market for the company.

While the U.S. had said earlier this year it would authorise H200 sales, China was reportedly pushing its companies to buy domestic alternatives. In May, Nvidia said export restrictions to China would cost it $8 billion in lost sales.

Nvidia shares were up around 1.6% in premarket trade.

What drove earnings?

Broader market dynamics helped ASML and SK Hynix’s earnings. There is a major shortage of memory chips, which are key components for consumer electronics and data centers. This has led to an unprecedented rise in prices for the components which helped SK Hynix, one of the world’s largest memory players.

Meanwhile, chip manufacturers are expected to expand production to meet demand for memory and other types of AI-related chips, such as Nvidia’s. ASML is the producer of so-called extreme ultraviolet lithography machines which are critical tools to manufacture the most advanced chips in the world. As chipmakers look to expand production, they will require ASML’s machines.

This demand helped the company report 13.2 billion euros ($15.8 billion) worth of bookings, a key metric for investors.

ASML and SK Hynix’s financials add to the positive signs in the semiconductor industry in the past few days.

Taiwan Semiconductor Manufacturing Co., the world’s largest contract chipmaker, reported record fourth quarter profit earlier this month.