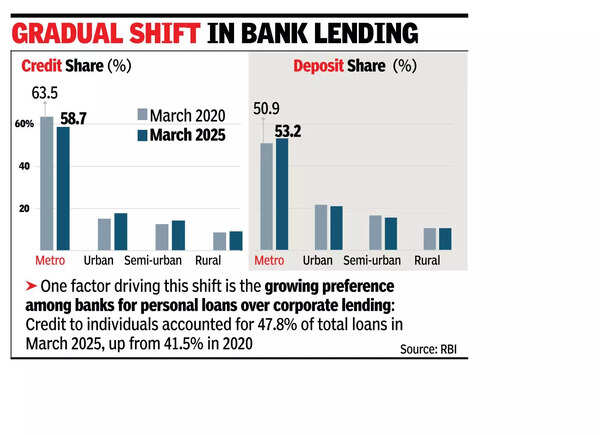

MUMBAI: In a gradual shift, share of bank deposits in metro cities has risen to 53.2% in March 2025 from 50.9% in 2020, even as their share in bank credit declined to 58% from 63% during the same period. The move is seem as a progress towards a policy goal of equitable distribution of bank funds across regions.One factor driving this shift is the growing preference among banks for personal loans over corporate lending. Credit to individuals accounted for 47.8% of total loans in March 2025, up from 41.5% in 2020, RBI data showed. Within this segment, the share of female borrowers rose to 23.8% from 22%.

For years, local politicians have demanded that deposits mobilised in a district or state be deployed for the development of that region. While metros still dominate the banking landscape, they are no longer pulling in deposit resources from across the country at the earlier scale.Another contributing factor is the movement of people and capital from metros to semi-urban areas. These regions have seen a rise in their share of deposits. As of March 2025, total individual deposits stood at Rs 234.5 lakh crore. Of this, metros accounted for Rs 124.8 lakh crore (53.3%), urban centres Rs 49 lakh crore (20.9%), semi-urban areas Rs 36.2 lakh crore (15.4%), and rural areas Rs 24.4 lakh crore (10.4%). In March 2020, the respective shares were 50.9%, 21.6%, 16.5%, and 10.9%. (see graphic) A similar pattern is visible on the lending side. Metro centres saw their credit share drop to 58.7% from 63.5%.Among personal loans, which have emerged as the fastest-growing category, growth slowed to 13.2% in FY25 but still outpaced overall credit growth. This lifted the segment’s share in total credit from 24.1% to 31% over five years. Housing loans became cheaper. The share of such loans with interest rates of 9% and above dropped to 36.8% in March 2025 from 54.5% a year earlier. Loans for consumer durables and other personal purposes – making up nearly a third of personal loans – also saw a decline in the share of high-interest borrowings (11% and above), from 50.3% to 47.4%.