MUMBAI: Led by a significant rally in bank stocks, Dalal Street experienced a strong upsurge on Monday. The sensex reclaimed the 79K level, while the Nifty rose above the 24K mark, both after more than four months. The BSE bankex rallied over 2% to a new all-time high during the day’s session.

The rally was driven by investors’ perception that, with a relatively smaller export share in global trade and a large domestic market, India could emerge mostly unscathed from the current global trade war, market players said. Banking stocks gained due to several tailwinds, such as the RBI’s liquidity infusion measures, a falling inflation rate, and expectations of an above-normal monsoon, combined, analysts noted.

However, the sustainability of the rally on Dalal Street was clouded by evening after US markets opened deep in the red, anticipating a clash between US President Donald Trump and Federal Reserve chairman Jerome Powell. All three leading US indices—Dow Jones, S, and Nasdaq Composite—were down more than 2% each.

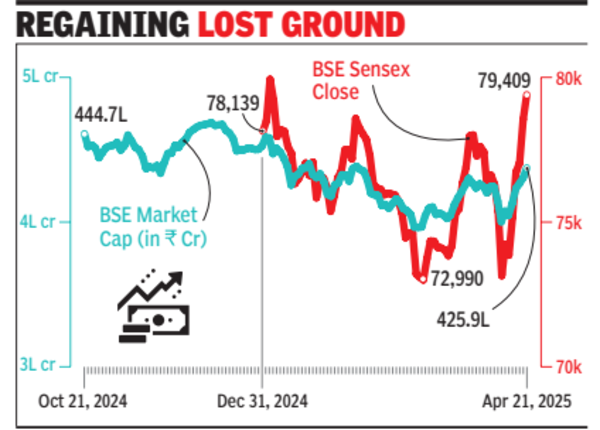

Meanwhile, at close of Monday’s trading, sensex was up 855 points or 1.1% at 79,409 points, while Nifty was up 274 points or 1.2% at 24,126 points. According to Devarsh Vakil, head of Prime Research at HDFC Securities, with a large, domestically driven economy and low reliance on exports, especially to the US, Indian markets were relatively insulated from tariff-related worries. Investor sentiment was also buoyed by solid earnings reports and positive management commentary from key banks, Vakil said. Foreign funds net bought stocks worth another Rs 1,970 crore on Monday, taking the aggregate net flows for the last four sessions to about Rs 17,000 crore, NSDL and BSE data showed.

The sudden reversal in foreign flows, combined with the weakness of the dollar against most major currencies, led to the strengthening of the rupee in recent weeks. On Monday, the rupee closed at 85.13 to the dollar, its strongest level since mid-Dec.

Among the sensex stocks, HDFC Bank, Reliance Industries, Infosys, and Axis Bank contributed the most.