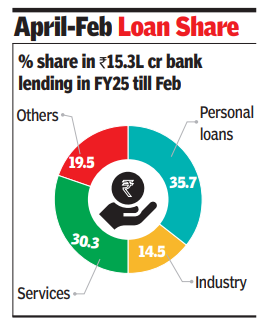

Within the total incremental non-food credit of Rs 15.33 lakh crore, personal loans accounted for the largest share at 35.71% (Rs 5.47 lakh crore). Services followed with a 30.3% contribution (Rs 4.64 lakh crore growth).

Within personal loans, housing loans grew by Rs 2.6 lakh crore, comprising 16.95% of incremental credit during the first eleven months. Banks have grown their home loan books more than their credit to industry which grew by Rs 2.22 lakh crore (14.51%).

Congratulations!

You have successfully cast your vote

Among other sectors, agriculture saw an incremental credit of Rs 1.93 lakh crore, contributing 12.59% to the total. Within industries, large industries saw a sluggish Rs 1.15 lakh crore growth. Within services, trade and commercial real estate were major sub-sectors.

Some sectors witnessed negative credit growth, indicating a contraction in bank lending. housing finance companies saw a reduction of Rs 1,051 crore, while public financial institutions saw a decline of Rs 9,369 crore.

Among the strongest-performing segments, trade grew by Rs 1.32 lakh crore, with wholesale trade growing by Rs 93,868 crore (6.12%). Loans against gold jewellery surged by Rs 88,636 crore (5.78%), reflecting increased collateral-based borrowing. Vehicle loans grew by Rs 46,384 crore (3.02%). Additionally, credit card outstanding increased by Rs 30,031 crore (1.95%), pointing to higher consumer spending through credit channels.