NEW DELHI: Industrial output growth slowed to a 6-month low in Feb, dragged down by sluggish manufacturing and mining sectors, while consumer non-durables remained in contraction territory.

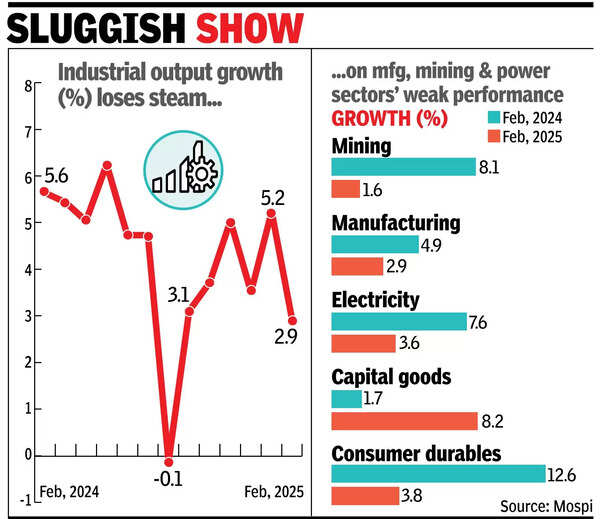

Data released by the National Statistical Office (NSO) on Friday showed the index of industrial production (IIP) grew by 2.9% in Feb, slower than the 5.6% in Feb last year and below the 5.2% in Jan.

The latest data comes against the backdrop of geopolitical tensions triggered by the bruising tariff war unleashed by US President Donald Trump. Most experts expect a dent to GDP growth although domestic demand is expected to help offset some of the impact.

The IIP data showed the manufacturing sector grew by 2.9% in Feb, slower than the 4.9% in Feb last year, while the mining sector rose 1.6% during the month, slower than the 8.1% in Feb 2023-24. The electricity sector grew by 3.6% during the month, lower than the 7.6% in Feb last year.

Consumer non-durables sector contracted 2.1% in Feb compared to a decline of 3.2% in Feb last year, while the consumer durables segment grew by 3.8% during the month, slower than the 12.6% in Feb 2023-24.

Experts said global uncertainty continues to cast a shadow on private investment and consumption and hoped that rate cuts unveiled by the Reserve Bank of India (RBI) and easing price pressures should provide some support.

“From a consumption standpoint, rural demand has been improving and is likely to remain supported by strong agricultural output and expectations of a normal monsoon. In contrast, sluggish urban demand continues to be a key concern,” said Rajani Sinha, chief economist at ratings agency CareEdge.

“Going ahead, global uncertainty continues to cast a shadow on both private investment and consumption. However, RBI’s second rate cut and expected moderation in inflationary pressures will provide some support,” said Sinha in a note.