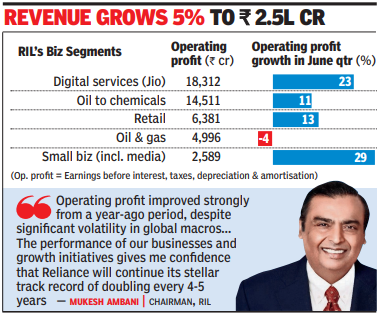

MUMBAI: Reliance Industries, India’s largest company in terms of market value, reported a 76% increase in quarterly profit to Rs 30,681 crore on Friday, led by gains from the sale of some of its listed investments and strong growth across its key businesses. Other income surged 280% to Rs 15,119 crore due to profit (Rs 8,924 crore) on sale of its stake in Asian Paints. Excluding the Rs 8,924 crore gain, profit was higher by 25%. Earnings was also driven by a rebound in its oil-to-chemicals (O2C) business, which saw better refining margins, and strong performance by its retail and digital services businesses. Revenue totalled over Rs 2.48 lakh crore, up 5%. Operating profit, a yardstick for underlying business performance, increased 14% to Rs 46,789 crore. Expenses climbed by 4% to Rs 2.26 lakh crore. Operating profit of O2C increased by 11% to Rs 14,511 crore due to favourable margins on domestic fuel retail, improvements in transportation fuel cracks and polyester chain margins.

Revenue grows 5% to Rs 2.5 lakh crore

Operating profit of the digital services business (Jio) surged 23% to Rs 18,312 crore due to higher revenues and strong margin improvement. Jio’s average revenue per user (ARPU) — a key metric that influences income — was Rs 209 in Q1FY26, up by about 15%. Launched in 2016, Jio had 498 million customers as of June 30, 2025, and saw data and voice traffic growth of about 24% and 5% on its network, respectively. Operating profit of the retail business shot up by 13% to Rs 6,381 crore due to strong performance in grocery and fashion. Consumer electronics was impacted due to the early onset of monsoons. Operating profit of the oil & gas business declined 4% to Rs 4,996 crore due to lower revenues and higher operating costs due to maintenance activity. RIL’s net debt at the end of Q1FY26 was Rs 1.17 lakh crore, and it had Rs 2.20 lakh crore in cash and cash equivalents. The company spent Rs 29,875 crore towards capital expenditure during the quarter.